![]()

Tag: Video

Looking towards a post COVID-19 world

COVID-19 webinar series: Jacob Mitchell explains some key factors the Antipodes team is considering when looking towards the COVID-19 recovery phase.

Identifying compelling investment opportunities in healthcare

COVID-19 webinar series: Dr Nick Cameron outlines how Antipodes identifies compelling investment opportunities within the global healthcare space.

A key metric for policy makers in the fight against COVID-19

COVID-19 webinar series: Dr Nick Cameron outlines a key healthcare metric that could determine the duration of COVID-19 lockdowns across the globe.

Identifying opportunities in a crisis

COVID-19 webinar series: During the Antipodes March webinar, focussing on the investment implications of the spread of COVID-19, Jacob Mitchell discusses how Antipodes views companies and sectors during a market crisis.

Why the US will struggle to deal with a COVID-19 recession

COVID-19 webinar series: Jacob Mitchell explains why the US will struggle to deal with the stimulus it needs to offset the credit crunch and solvency risk resulting from the impacts of the spread of COVID-19.

Junk bond market tail risk and the companies to be hit hardest

COVID-19 webinar series: Jacob Mitchell explains that unlike the GFC, banks have approached the COVID-19 economic downturn with sound balance sheets. Much of the junk bond market tail risk lies in institutional and retail balance sheets.

3 unknowns that will determine the severity of the COVID-19 downturn

COVID-19 webinar series: Jacob Mitchell outlines three unknowns which Antipodes believes will ultimately determine the severity of the developing economic downturn.

Growth traps: Why investors should be wary

In this video, Jacob Mitchell explains why investors must be cautious about growth traps, along with value traps, as multiple dispersion widens across all sectors.

Challenging the consensus: Is the world becoming Japan?

Is the world becoming Japan? It’s a question many investors are asking with interest rates falling to all-time lows across the world and real growth expectations collapsing.

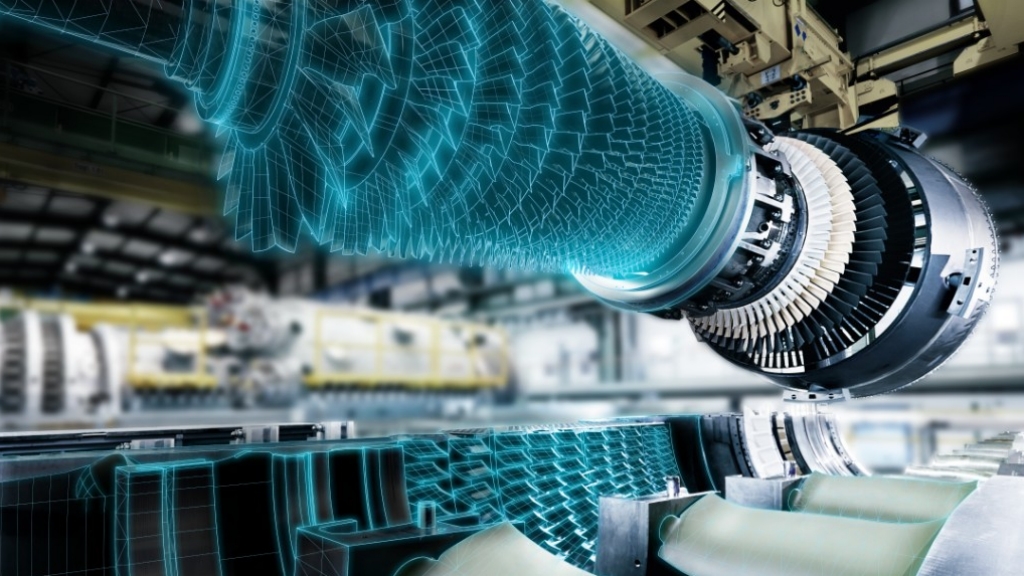

Siemens: Quality and growth, without the headlines

Andrew Gibson, Senior Investment Analyst, takes a closer look at how digital technology can help Siemens grow without being dependent upon the economic cycle.