![]()

Tag: Article

White paper: The catalysts to unlocking value

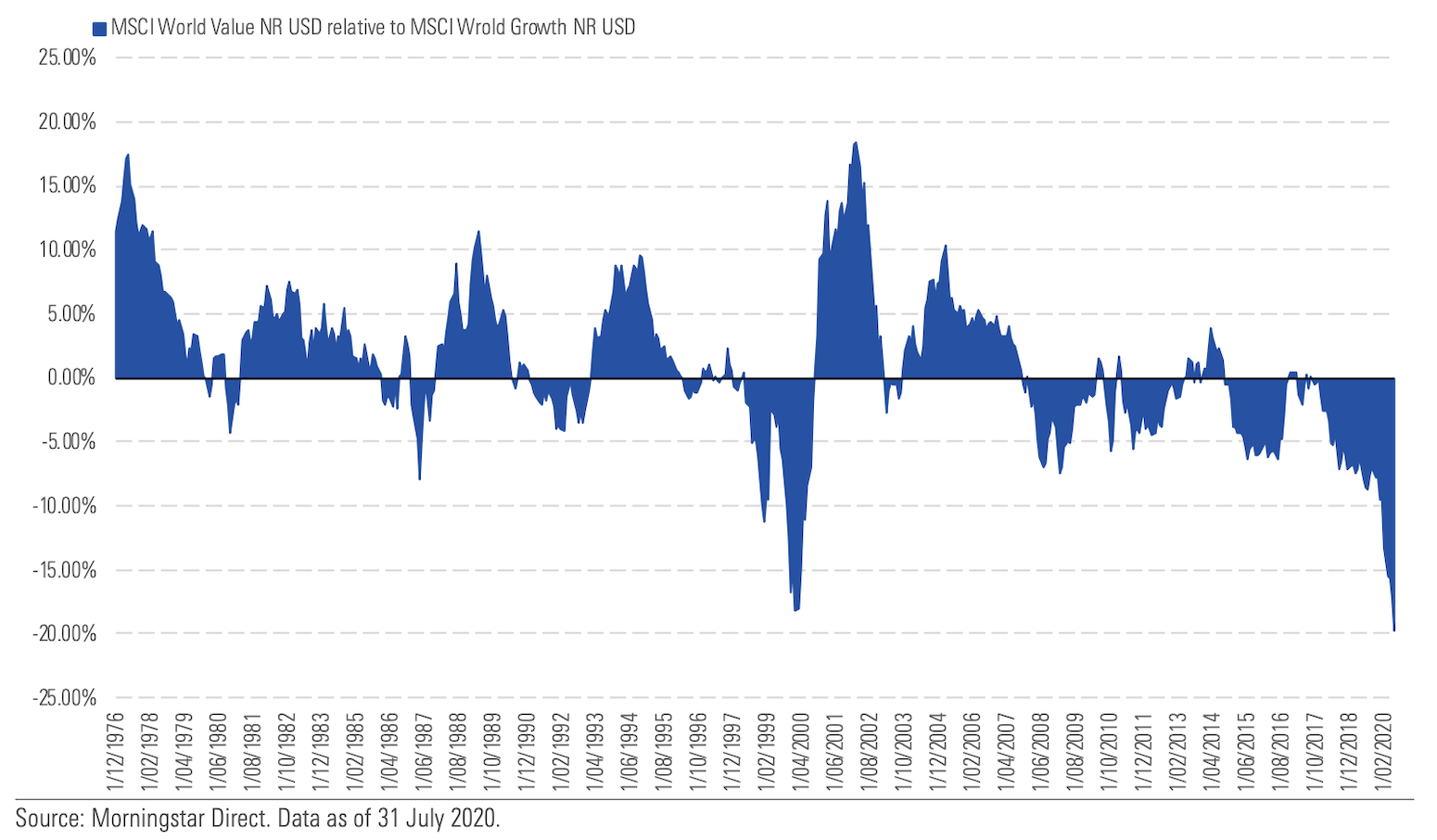

In this white paper, Alison Savas, outlines the central case and key catalysts for a regime change in markets – where investors turn from growth to value.

When pessimism rules, investment opportunities can emerge

Could the current market pessimism surrounding financials present a unique investment opportunity? In this article, Vinayak Muralidharan analyses the investment case for one US retail bank with significant embedded value.

Why value matters when growth is on a tear

Jacob Mitchell explains why it’s more important than ever for investors to maintain a value-style exposure in their investment portfolios.

AFR: Is the herd being led into growth purgatory?

In this article written for The Australian Financial Review, Jacob Mitchell discusses the perils of buying stocks trading on excessive multiples.

Could extreme market cap/performance concentration signal a turning point?

Despite a global pandemic that has been sending shock waves through economies, market cap concentration has surpassed previous historical highs seen during the dot-com bubble. Could this be signalling a turning point?

Investing in Microsoft: A pragmatic value story that’s far from over

Finding attractive value in one of the world’s biggest companies might seem unusual for a value investor and to many Microsoft may seem expensive.

However, we’d argue that the rerating is justified.

China’s ‘new retail’ revolution: A generational opportunity

In this article, Sunny Bangia provides in-depth analysis on Alibaba and JD.com, two companies at the forefront on the new retail revolution underway in China.

Honda: A compelling investment case within an unloved sector

The auto sector frequently graces the headlines for all the wrong reasons, but a company we believe provides a compelling investment opportunity is Honda.

Merck & Co: Defensive growth and quality at an attractive valuation

Jacob Mitchell outlines why Antipodes believes pharmaceutical giant Merck offers investors exposures to defensive growth and quality attributes, at a highly attractive price.

Fiscal stimulus: The inevitable response to the world’s economic woes

Ultimately, we believe it is inevitable that countries will seek to generate growth through fiscal stimulus. What will this mean for bonds and bond-like equities which have now grown to account for more than 40% of the global market cap?