Every investor knows that past performance isn’t a reliable indicator of future results, yet many are attracted to established winners whose stock price may have been hyped to unrealistic heights. We think it’s better to focus on finding attractively priced businesses with the potential to become tomorrow’s leaders.

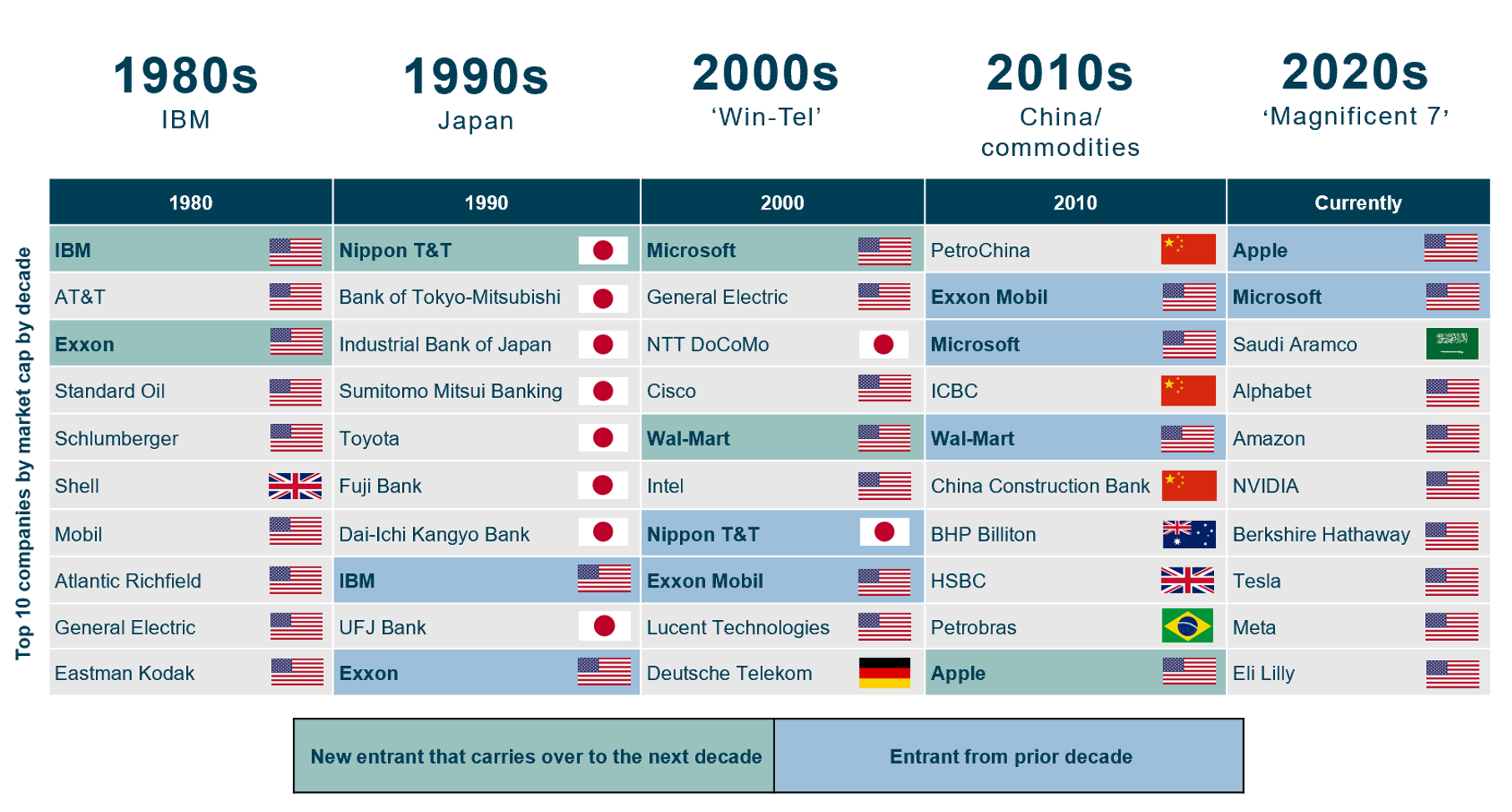

Every market cycle sees a reshuffling of previous winners as new investment cycles and disruptive technologies emerge. Just as empires and economies rise and fall, history shows how successful companies can fall back into the pack as ambitious and fast-growing new businesses accelerate into the lead. If you have any doubts about that, just take a look at Figure 1.

Back in the 1980s, industrials and energy companies dominated the top ten, with IBM the only technology company. Microsoft and Intel were among IBM’s biggest suppliers before they ultimately soared past “Big Blue” as software and integrated circuits, not hardware, became the source of value. The presence of oil companies reflected the oil shock of the late 1970s, which sent energy prices surging.

A strong economy, low borrowing costs, easy access to credit, and a property boom proved a heady cocktail in Japan in the 1980s, propelling market capitalisations to astonishing highs. The price-to-earnings ratio of the Nikkei rose above 60x at its peak, compared with a global average of 15x. But valuations matter, and bust inevitably followed boom as monetary policy tightened.

Figure 1: The ever-changing league table of corporate high fliers

Source: Research Affiliates, Antipodes.

Source: Research Affiliates, Antipodes.

Meanwhile, the dotcom mania of the late 1990s drove tech companies to the top of the tree. The leaders included Microsoft, which was valued at an astonishing 65x forward earnings at one point. Its share price fell by 60% in the tech wreck that followed – but being a high-quality business, it survived and prospered further – while many of the tech stars failed to deliver on their promises and disappeared from view.

China’s stimulus-led growth excited investors in the following years and beneficiaries of this growth moved into the top ten. Yet now they’ve dropped out as the pace of Chinese growth slows.

Today, US tech stocks – if you count Tesla – account for seven of the top ten corporate behemoths. Of these “Magnificent Seven”, Microsoft and Apple are the only companies that featured ten years ago.

Learning from history

The lesson is clear: it’s best to focus on finding tomorrow’s winners, rather than targeting yesterday’s stars.

That’s precisely what we aim to do at Antipodes. We seek to avoid both value and growth traps. Value traps are low-multiple stocks that structurally underperform as valuations weaken due to rising competition, while growth traps are companies that are priced to perfection but see historical growth rates fall as they become more cyclical and disappoint lofty market expectations.

Picking winners

Instead, we identify key trends – such as artificial intelligence (AI), connectivity and compute, the energy transition, and supply-chain onshoring – and target attractively priced companies that are best placed to benefit from them. Stock picking, in other words, is crucial.

AI is a long-term trend in the early phase of adoption and monetisation, and we see as many losers as winners as more and more capital is deployed. Today, the key potential for AI lies in the ability to drive productivity and revolutionise the way businesses serve customers. So, we think B2B monetisation will be much easier than B2C and are positioned for this via investments in Microsoft, Oracle, SAP and Amazon.

We also like Siemens, which is well-positioned to benefit from both onshoring and the drive to net zero. It’s a global leader in factory automation: manufacturing lines need to be redesigned and retooled for a low-carbon world. Siemens also produces energy-efficient systems that manage power consumption, and it’s a global leader in signalling equipment for railways – the most environmentally friendly form of transport and critical to reducing emissions in the transport sector. Yet Siemens is priced at less than 12x earnings, with sales growing by more than 10% per year.

The market’s focus on a handful of perceived winners, including businesses that may find it difficult to maintain (let alone accelerate) growth rates should economic activity continue to slow, provides opportunities for those prepared to look beyond the consensus.

To learn more about the importance of concentrating on valuations and ignoring the media hype around certain stocks, read our insights article.

Subscribe to receive the latest news and insights from Antipodes

IMPORTANT INFORMATION:

All content in respect of the Antipodes Global Shares (Quoted Managed Fund) (ARSN 625 560 269), the Antipodes Global Fund – Long (ARSN 118 075 764), the Antipodes Global Fund (ARSN 087 719 515), and the Antipodes Emerging Markets (Managed Fund) (ARSN 096 451 393) is issued by Pinnacle Fund Services Limited ABN 29 082 494 371 AFSL 238 371 (“PFSL”) as responsible entity of the Funds and is prepared by Antipodes Partners Limited (ABN 29 602 042 035) (AFSL 481580) (“Antipodes”) as the investment manager of the Trust. PFSL is not licensed to provide financial product advice.

The information provided is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Funds, you should consider the current Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Funds and the Fund’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au, and assess whether the Fund is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser. The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the relevant Fund are available via below links. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Links to Product Disclosure Statement: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

Links to Target Market Determination: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

Neither PFSL nor Antipodes guarantees repayment of capital or any particular rate of return from the Funds. Neither PFSL nor Antipodes gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this content. All opinions and estimates included in this website constitute judgments of Antipodes as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.