Key points

- On an equal weighted basis, global equites are down almost 6% this year – liquidity is driving a handful of stocks, but this backdrop is changing

- The US fiscal deficit will remain elevated, and it will need to be funded via longer-term government bonds – the US yield curve will need to steepen to create demand

- High multiple stocks and stocks that have been supported by the liquidity-led rally remain vulnerable in a higher for longer yield environment

- Position for tomorrow’s winners – every market cycle sees a reshuffling of previous winners due to new investment cycles and disruptive technologies – and we discuss two stocks investors should be paying attention to

The global equity index has risen 5% this year – but performance at the headline level masks the concentration in markets. On an equal weighted basis, the index is down almost 6% over the same period (this is where each stock is weighted equally as opposed to weighted by market cap). The divergence between the two shows that index performance has been driven by a handful of large stocks.

In a similar vein, the top 10 stocks in the S&P now account for one-quarter of the index – another example of crowding into a handful of perceived winners.

Such narrow performance does not support a soft-landing narrative. What we’re really seeing is a supportive liquidity environment propping up a few stocks.

Fiscal activism vs the Fed

Over the last six months the funding needs of the US government from a widening budget deficit have been met via issuing short-dated Treasury Bills rather than long-dated Treasury Bonds – this has supported liquidity in markets.

Let’s unpack this.

T-Bills were purchased by money market funds that would have otherwise had their cash parked dormant with the Fed as T-Bills offer a more attractive yield for a similarly safe, short duration asset.

To labour the point, liquidity wasn’t sucked out of other assets to fund the T-Bill issuance – cash simply moved from an account sitting with the Fed into Bills – and by issuing short-dated debt the US Treasury was able to avoid upward pressure on long-term (10-year) government bond yields.

This has supported equities, in particular mega-cap tech given excitement around AI and relatively resilient earnings due to cost control. Collectively the Magnificent 7 are now priced at more than 30x earnings, though within the group multiple dispersion is high – Meta is priced at 17x times forward earnings versus Tesla’s 55x.

But this backdrop is changing.

The US Treasury has historically maintained a mix of short-dated and long-dated funding. Short-dated debt is now at the upper-limit of the Treasury’s historical mix.

The fiscal deficit is expected to reach 6% of GDP next year – one the highest deficits since 1946, and this is in the context of near record low unemployment! This deficit is likely to remain elevated even with a highly dysfunctional US government as Democrats and Republicans are united on protecting leading edge technology and onshoring supply chains, while healthcare and social programmes will only intensify as the population ages. This spending must be funded.

The Treasury ultimately has plenty of flexibility around its debt mix, but we expect that over time it reverts to the historical average. That is, this very large deficit will increasingly be funded via issuing long-dated bonds. But before this terming out of the debt has even started, the yield on the US 10-year government bond has risen sharply, edging close to 5%. This is the highest level since early 2007.

The two largest buyers are out of the market; the Fed, which is adding to the supply of Treasuries via QT, and banks. Also, current yields aren’t attractive for many foreign investors given the high cost of hedging the currency, and there will be some foreign governments where the memory of Russia’s frozen assets will weigh heavily on a decision to invest – or not invest – in US Treasuries. That leaves the US household to step in via higher savings rates or by selling other assets.

So, what does this mean for stocks?

Bond prices fall with higher yields, and so too can equities. Higher yields equal higher discount rates which compress PE multiples. High multiple stocks will be vulnerable in this environment.

So, while equities and bonds have historically been negatively correlated – equities have outperformed when bonds have underperformed, and vice versa – more recently bonds and equities have been very positively correlated. In fact, their correlation is as high as it’s been in over 20 years. Bond volatility is also very high relative to equity volatility – evidence that funding pressures are very real even before the Treasury starts to term out its debt.

These long-dated bonds will be bought but the question is at what price. Either yields will need to increase to attract household demand to soak up the supply that’s coming or the Fed will need to cut rates and reverse QT to take pressure off the long end of the curve. Hence, a dovish pathway for inflation from here is critical to the Fed’s ability to stick the soft landing.

As Pragmatic Value investors we are disciplined around seeking out companies that are mispriced relative to their business resilience and growth profile to build a margin of safety into our portfolios.

While the market remains fixated on the same seven stocks that have been supported by the recent liquidity-led rally, anchoring to previous winners could be a mistake.

These companies will be vulnerable to a de-rating in a higher yield environment if forward earnings do not meet expectations Consumer facing businesses – e.g. Tesla, Apple, Meta, Alphabet – may find it difficult to maintain (let alone accelerate) growth rates should economic activity continue to slow. Some are maturing which means their growth profile will become more cyclical. And as we’ve seen in this results season, the market is punishing stocks that disappoint expectations.

Every market cycle sees a reshuffling of previous winners due to new investment cycles and disruptive technologies.

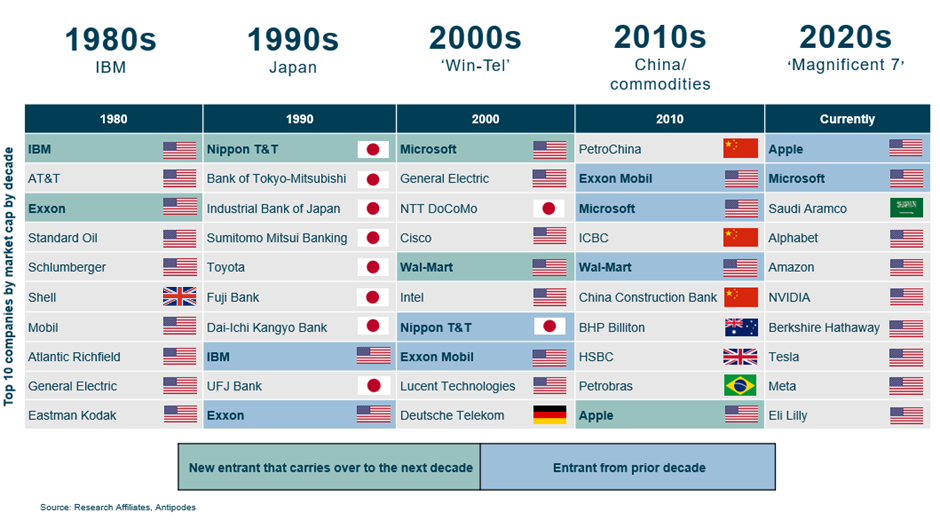

Figure 1: Expect a re-shuffling of winners

Source: Research Affiliates, Antipodes

Figure 1 shows the largest company in the world in 1980 was IBM, who did not realise that its biggest suppliers – Microsoft and Intel – would ultimately surpass it as software and integrated circuits became the source of value, not hardware. And the Top 10 was also dominated by oil companies following the oil shock in the late 1970s.

Enter the 1990s, and only two companies remained in the Top 10 as Japan’s dominance rose. A strong economy, low rates, easy credit and a property boom were a heady cocktail until policy tightened.

Fast forward to the next decade, and again two of the Top 10 survived in the early noughties – defined by the tech bubble. Microsoft – then a great company just as it is today – re-rated to 65x forward earnings. It fell 60% in the tech wreck, and many ceased to exist. Valuations matter.

China’s stimulus-led growth dominated the Top 10 in 2010, and only three companies from the prior decade remained in our list.

Finally, today – the AI revolution – Microsoft and Apple remain, accompanied by a host of new entrants.

This history lesson shows that rather than wedding to yesterday’s winners, the bulk of which get knocked off their pedestal, investors need to focus on finding tomorrow’s winners.

Our investment approach seeks to avoid both value and growth traps. Value traps are low multiple stocks that structurally underperform as valuations weaken due to rising competition, and Growth traps are companies that are priced to perfection but see historical growth rates fall as they become more cyclical and disappoint lofty market expectations.

AI is a long-term trend in the early phase of adoption and monetisation where we see as many losers as winners as more and more capital is deployed. Today the key potential for AI lies in the ability to drive productivity and revolutionise the way businesses serve customers. However, we think B2B monetisation will be much easier than B2C and are positioned for this via portfolio holdings Microsoft, Oracle, SAP and Amazon.

The other trends that will dominate the next decade (and beyond) are energy transition and supply chain onshoring. Given we are at the foothills of a policy-led investment super cycle, many of the beneficiaries are not yet efficiently priced.

Siemens is a great example. It’s a global leader in factory automation, and manufacturing lines need to be redesigned and retooled in a low carbon world, and this business will also benefit from onshoring. Siemens produces energy efficient systems that manage power consumption and it’s a global leader in rail signalling equipment and rail is the most environmentally friendly form of transport and critical to reducing emissions in the transport sector. But it’s still available at less than 12x earnings and growing more than 10% p.a

We’ve also been adding to global cyclicals with attractive supply/demand dynamics that are cheap. Stocks like Occidental Petroleum, a US-focused oil major with access to low-cost oil in the Permian. It’s also a leader in carbon capture technology, a critical element to achieving net zero. And we’re finding opportunities to allocate capital to cyclicals with characteristics that indicate “bottom of the cycle” (destocking has played out, low inventories, weak pricing) which remain priced for continuing weakness.

While the range of outcomes remains wide, concentration around a handful of perceived winners means opportunities exist for those prepared to look wider than consensus.

Subscribe to receive the latest news and insights from Antipodes

IMPORTANT INFORMATION:

All content in respect of the Antipodes Global Shares (Quoted Managed Fund) (ARSN 625 560 269), the Antipodes Global Fund – Long (ARSN 118 075 764), the Antipodes Global Fund (ARSN 087 719 515), and the Antipodes Emerging Markets (Managed Fund) (ARSN 096 451 393) is issued by Pinnacle Fund Services Limited ABN 29 082 494 371 AFSL 238 371 (“PFSL”) as responsible entity of the Funds and is prepared by Antipodes Partners Limited (ABN 29 602 042 035) (AFSL 481580) (“Antipodes”) as the investment manager of the Trust. PFSL is not licensed to provide financial product advice.

The information provided is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Funds, you should consider the current Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Funds and the Fund’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au, and assess whether the Fund is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser. The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the relevant Fund are available via below links. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Links to Product Disclosure Statement: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

Links to Target Market Determination: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

Neither PFSL nor Antipodes guarantees repayment of capital or any particular rate of return from the Funds. Neither PFSL nor Antipodes gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this content. All opinions and estimates included in this website constitute judgments of Antipodes as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.