Today, investors find themselves in the midst of a “growth at any price” bubble, characterised by very high concentration in market capitalisation, narrow performance breadth and extraordinarily high valuation multiple dispersion. The chase for high growth has been driven by a generational collapse in real yields with COVID-19 acting as an accelerant. This outcome has left many questioning whether a conventional approach to value investing is dead.

Pragmatically, we have suggested that a successful COVID-19 vaccine was key to any regime change, and on 9 November Pfizer/BioNTech announced encouraging news regarding their vaccine trial involving more than 43,000 candidates to date. Data released suggests the vaccine has greater than 90% efficacy with an acceptable safety profile. While we await full data disclosure, based on the announced efficacy result, this level of effectiveness approaches that of the measles vaccine and is far superior to the 40 – 50% efficacy achieved by seasonal flu vaccines. These results suggest Pfizer/BioNTech’s and other vaccines in development, have a great chance of becoming successful weapons against the virus.

This outcome is material for consumers to have the confidence to normalise behaviour.

Before we delve further into vaccines, let’s look more deeply at how markets have been behaving.

Growth versus Value Investing debate

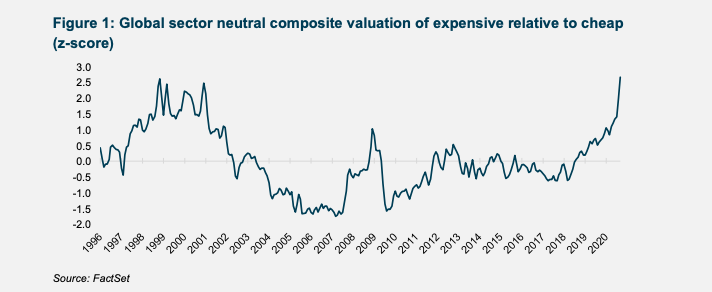

The outperformance of high multiple (growth) stocks relative to low multiple (value) has accelerated since 2018 with COVID-19 adding more fuel to the fire. Multiple dispersion has reached extraordinary levels across every sector, now exceeding the levels reached in the dot.com bubble, illustrated in figure 1. This is not just a market led outcome of a preference toward tech stocks versus ‘old world’ companies. Within every sector the difference between what investors are prepared to pay for stocks they like (perceived winners) versus stocks they don’t like (perceived losers) is as wide as it has ever been in 25 years.

Some may argue the nose-bleed valuations of today’s market leaders are justified because they are applied to great businesses – disruptors and leaders of seismic structural change. Yes, disruption is real, and many at the forefront of change will be great businesses, but this does not automatically make them great investments at today’s elevated multiples.

We’ve been here before.

With the current extreme degree of multiple dispersion there are likely to be just as many growth traps as there are value traps. As the dot.com bubble burst great businesses like Microsoft and Cisco de-rated for extended periods. It took investors who bought into those names at the height of the bubble more than a decade to recoup their money, even though those businesses continued to grow.

When it comes to long term capital preservation, the dot.com bubble is a textbook example of why value-style exposures in investment portfolios are so important.

Capital preservation aside, what does the pathway to a market rotation to value look like in today’s global climate?

A rotation into ‘value’, or the compression of extreme multiple dispersion, typically occurs around a cyclical rebound in economic activity (last seen in 2016-17), or on a much longer duration basis due to a fundamental shift in the investment composition of the economy. This latter type of ‘value’ outperformance occurred post the tech wreck and lasted more than a decade via the combination of a US housing/financials super-cycle that ended in 2008 and the emergence of China into the world trading system, which triggered a resources super-cycle that ended in 2012.

Today, we see potential for a cyclical rebound occurring on the back of economies reopening and COVID-19 vaccines being developed, along with a change in investment preferences led by government stimulus.

Reopening

The continued reopening of the global economy is material to a cyclical recovery. There are positive signs on this front. Currently, the US, Europe and China appear reluctant to go back into lockdown, while the Chinese economy has rapidly normalised without a vaccine (and with the fiscal position and government debt intact).

In China, hotel occupancy and domestic air passenger movements are at pre-COVID levels of activity, and retail, property and auto sales have normalised. Europe and the US are following a similar pathway towards reopening, which is different to what is being experienced in Australia where many domestic borders remain closed.

Vaccines

The pathway towards a formal full reopening may not be straightforward. As northern hemisphere winter approaches, infection rates on a detected basis are expected to rise due to the seasonality of the virus and increased testing capacity. It will pay to closely track mortality rates, which have thankfully fallen to under 2% from mid-single digits in the early stages of the outbreak. Lower fatality has been driven by more testing, better treatments and improved clinical management.

The key for consumers to fully normalise behaviour will be successful vaccines. The likelihood of vaccine success was predicted by some researchers to be relatively high given the SARS-CoV-2 virus (causes COVID-19) mutates relatively slowly and because it has a clear target for vaccine manufacturers to attack (the spike protein).

This prediction has been reinforced by the recent release of Pfizer’s vaccine trial data, indicating vaccine efficacy greater than 90%, meaning more than 90% of candidates given the vaccine did not produce symptoms of the virus. The duration and extent of efficacy is important as the stronger the vaccine is, the faster transmission rates can fall, and herd immunity can be reached.

Emergency use authorisation could be granted by the US regulator (FDA) as early as mid-December, with priority access likely given to aged-care residents, front line healthcare workers and then the elderly or more broadly at-risk individuals. Pfizer alone is expected to have more than 50 million doses of vaccine available by year end and 500 million doses by early second-quarter 2021. Vaccine availability by year end could reach as high as 70 million doses as we believe Moderna’s vaccine, which is very similar to Pfizer’s, may have similar success. Mass availability in the US and some developed countries could begin in the middle of 2021; by the end of next year Pfizer and Moderna’s announced vaccine dose production together could reach in excess of 1.8b doses.

With first-generation vaccines, uncertainty regarding durability should be offset by the ability to “boost” or top-up dose. Efficacy in the elderly is still unknown but again boosting should help to increase responses. Looking ahead to the second-generation vaccines (Sanofi/GSK and Novavax), which use more traditional protein-based approaches, durability and efficacy are likely to be improved. The addition of adjuvants to vaccines has a long track record for boosting effectiveness (Sanofi is a portfolio holding). Mass availability of second-generation vaccines could emerge in the second half of 2021 if data is supportive.

We discussed the outlook for vaccines in detail during a recent Antipodes podcast episode in which healthcare Portfolio Manager Dr Nick Cameron spoke to Dr Michael Farzan, one of the world’s leading experts on COVID19 vaccine development.

With unprecedented investment by governments and the private sector, vaccine production could reach above 6 billion doses through 2021 if the major vaccine developers are all successful.

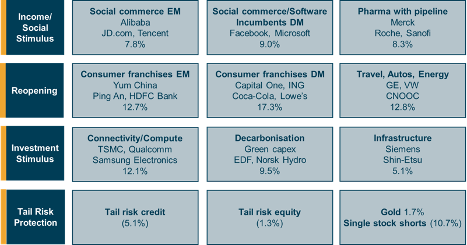

It is the more cyclical parts of the market – financials, retail, travel – which disproportionately benefit from this normalisation, including Antipodes portfolio holdings such as leading US credit card company Capital One Financial (post regulatory approval, offering a sustainable 10% payout yield, including dividends and buybacks), Volkswagen (emerging global leader in electric vehicles) and consumer businesses like Coca Cola (almost half the company’s sales are generated via on-premise consumption).

In China, with economic growth rebounding strongly even without a vaccine we see opportunities in leading internet platforms such as Alibaba (services both emerging consumers in China and the wealthy who are trading up), and dominant consumer franchises that have suffered due to social distancing such as Ping An (Chinese life insurance is materially under-penetrated and face-to-face sales are starting to rebound), and Yum China (China’s leading quick service restaurant franchise where dining out is also coming back).

Stimulus

Even with a vaccine, and certainly in the interim prior to mass availability, western income stimulus will remain important. Governments will increasingly look towards directed investment spending to generate economic activity e.g. decarbonisation, tech infrastructure, healthcare, social spending. A stronger shift away from income stimulus to investment stimulus will lead to a more sustained outperformance of lower multiple, more cyclical stocks.

A good example is Europe’s New Green Deal, a commitment to make the EU carbon neutral by 2050, which will include a legally binding target to cut emissions by at least 55% by 2030. To meet these goals requires investment in renewables, the grid and infrastructure to store and secure supply. This infrastructure supercycle is estimated at €4t over the next decade, or incremental investment worth 2% of GDP p.a. for the next 10 years.

In this sense we question whether we have permanently entered a low growth environment.

The huge investment stimulus governments are being forced into (by both constituents and economic necessity) as a result of COVID-19 may lead to a switch from a ‘virtual’ to a real asset investment cycle.

Antipodes is well-positioned to take advantage of this shift via portfolio holdings like EDF (Électricité de France) (low carbon electricity producers, which will earn a return from ‘greening’ the grid), materials companies such as Norsk Hydro (a sustainable aluminium producer, where aluminium content is set to increase in a low carbon world) and enablers such as Siemens (global leader in factory automation and energy efficiency).

Regime change: When investors turn to Value

The COVID-19 health crisis has accelerated what was becoming an inevitable shift towards fiscal activism. The recent news on vaccines gives greater confidence around reopening. This, coupled with excess savings and pent up demand from lockdown, supply chains ‘moving home’ (in part as a consequence of US-China trade tensions and a need to create employment) and investment stimulus increases the odds of a regime change. With the election now all but behind us we expect to see more fiscal stimulus from the US even with the potential of a split congress. Stimulus will be more muted than what would have been likely under a “blue wave” outcome however we expect to see stimulus that is agreeable to both sides of politics, likely incorporating both income and investment elements.

We are likely at the beginning of a fundamental shift which will lead to greater volatility in goods and services inflation, higher real rates and a long-term shift in investment preferences.

This is positive for compression in multiple dispersion and the outperformance of Value.

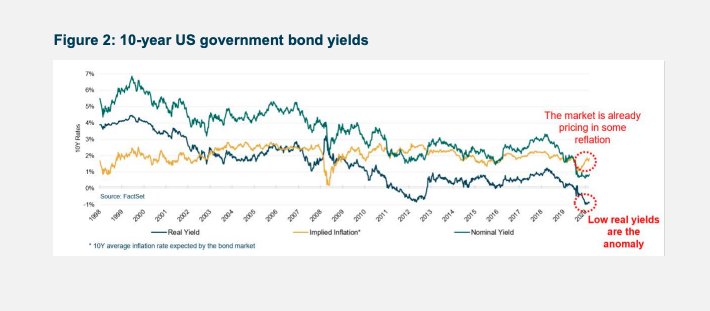

Indeed, the market is already beginning to price in some reflation, seen in rising breakeven inflation rates (Figure 2), commodities (for example in precious and base metals, agriculture) and cyclical currencies (for example, the Australian dollar). It is the yield on long bonds that is the anomaly thanks to central bank intervention.

Source: FactSet

The rubber band on falling real rates and the melt-up in growth appears very stretched. After all nominal yields were 1.5– 2% only a year ago and real yields were positive. Any sustained move higher in real rates would represent a painful headwind for the weaker businesses within the growth complex.

Portfolio positioning

The major tilts in the portfolio are towards good quality cyclicals with embedded growth opportunities across North America and Europe and China/Emerging Market consumption exposures, and away from expensive growth/defensive stocks in the West.

With the aforementioned data points in mind, we have been pivoting towards ‘Reopening’ and ‘Investment Stimulus’ beneficiaries. Our exposure to these clusters (domestic businesses and global cyclicals) has increased by 10% on a net basis since September (to mid-November) at the expense of global defensives (software/internet, healthcare, precious metals), where net exposure has fallen by 5%.

As China emerges from COVID-19 in exceedingly good shape (real GDP growth is forecast to increase 2.5% this year versus -4% in the US and -7.7% in Europe), the risk/reward of these tilts is looking even more attractive. Chinese economic growth slowed through 2018-19 and hence there is a case for pent-up demand and a significant overshoot in the current Chinese rebound. Growth in China will likely feed back into global growth via the export channel. Europe has more sensitivity to this than the US given exports account for 20% of Europe’s GDP versus 12% in the US.

Despite this, we still have significant exposure to the US, focused on “Reopening” beneficiaries and multinationals that are part of our ‘Investment Stimulus’ post-COVID-19 roadmap.

Source: Antipodes (as at November 2020)

Holding the line on Value

Investors who continue to chase growth at any price are playing a risky game. In the midst of a bubble, value-style exposures in investment portfolios are critical for long term capital preservation.

As outlined above, there’s a pathway forward for an ongoing cyclical economic rebound thanks to vaccine development and post-COVID-19 reopening. Coupled with evolving government directed investment, this can shift the market’s focus away from growth at any price, sparking a broader regime change in which today’s misunderstood lower multiple stocks can become the market leaders.

Subscribe to receive the latest insights and updates from Antipodes