Download PDF >

This paper introduces Global Credit investing, highlighting its attractive risk/return profile, diversification, and liquidity benefits. We also outline why Global Credit should be a core component of any investor’s portfolio asset allocation.

A very large opportunity

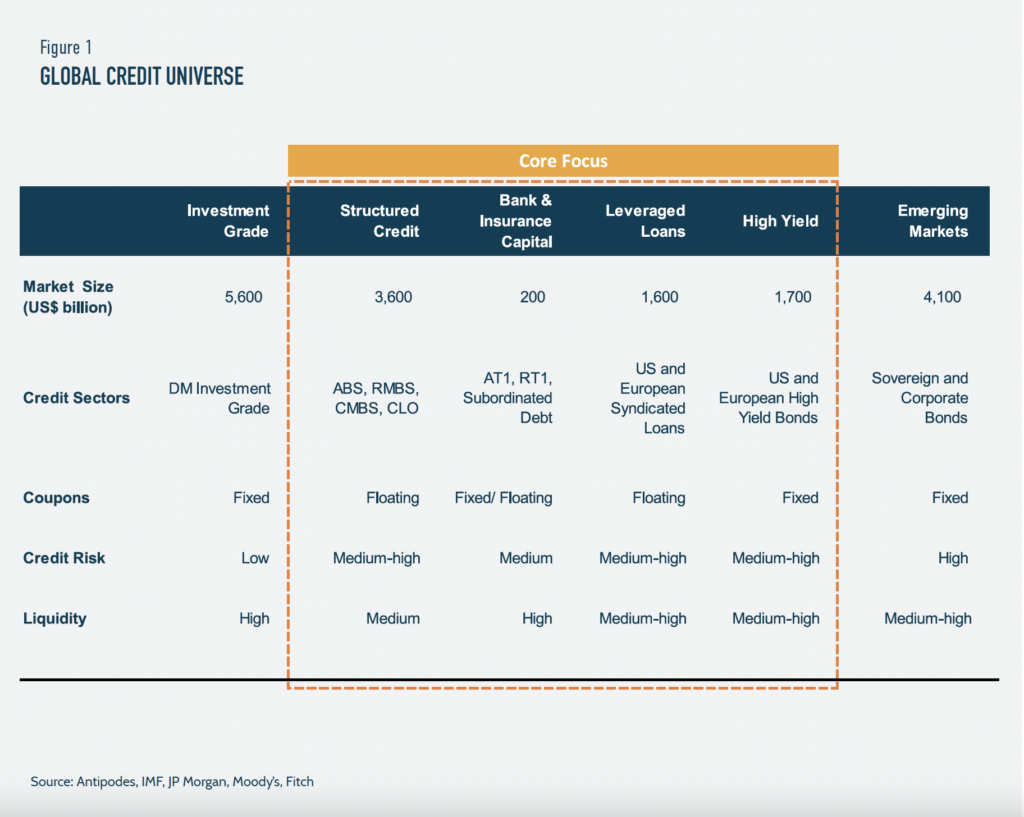

The Global Credit investment universe includes investment grade corporate credit, structured credit, bank capital, leveraged loans, high yield, and emerging market fixed income (see appendix for definition).

The Antipodes Global Credit team deliberately narrows the investment universe to focus on fixed income where credit spreads, rather than base rates, drive returns. We exclude investment grade credit, where returns are primarily driven by interest rate positioning. We expect that investment grade credit will largely function as a cash-alternative in portfolio asset allocation through the cycle. We also exclude emerging market debt given the considerable reduction in legal protections and security associated with investing outside of developed credit markets.

Today, our more focused credit universe is ~US$7.2 trillion, or approximately 2.5x larger than the combined Australian equity and fixed income markets, however accounts for <5% of the average Australian portfolio.

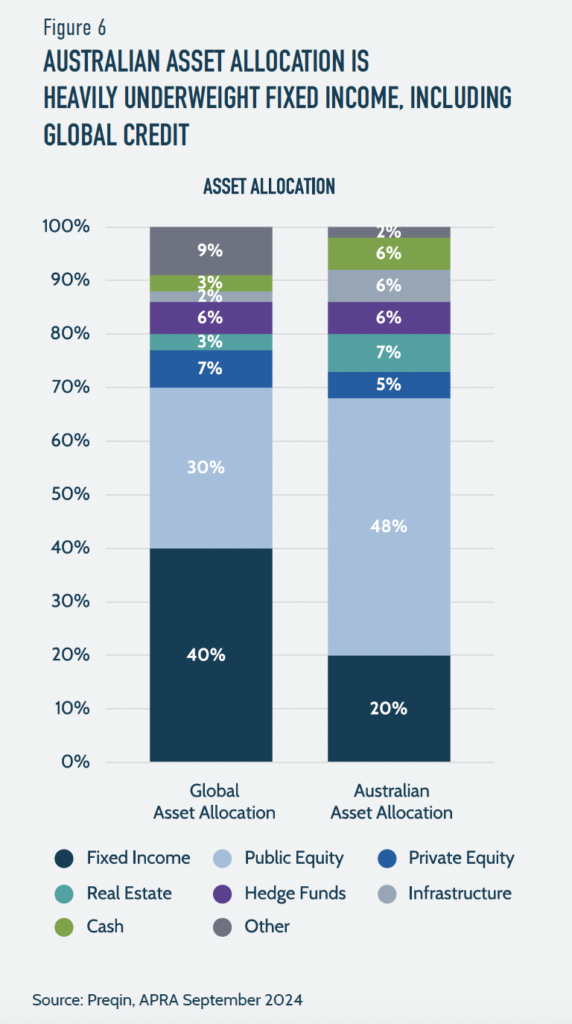

While Australians have become very comfortable with investing in global equities, with international equities accounting for ~30% of portfolios, they are typically underweight the lower-risk alternatives available in credit markets. We see this as a significant asset allocation mismatch.

Common characteristics of Global Credit include: legal security, contractual coupons, defined maturities, and security-level liquidity. However, risk-return characteristics vary significantly between credit sub-sectors, highlighting the need for active management.

Attractive risk-adjusted returns

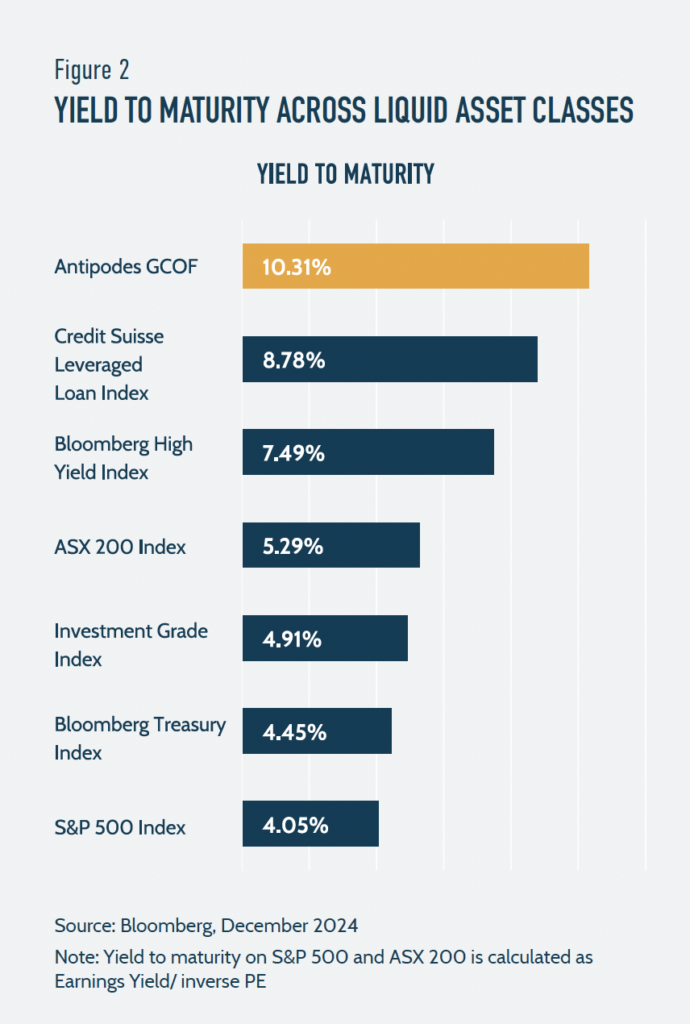

High single-digit yields in Global Credit offer a margin of safety relative to expected defaults and healthy incremental return relative to both Treasuries and Investment Grade Credit. The rapid increase in base rates since late 2022, has resulted in a highly attractive total return credit environment.

Comparing credit market yields to maturity to the earnings yield of the S&P 500 and ASX 200 also highlights that current equity valuations imply a negligible equity risk premium. Therefore, investors need to be confident about earnings growth, and the stability of current valuations, to achieve double-digit equity returns going forward.

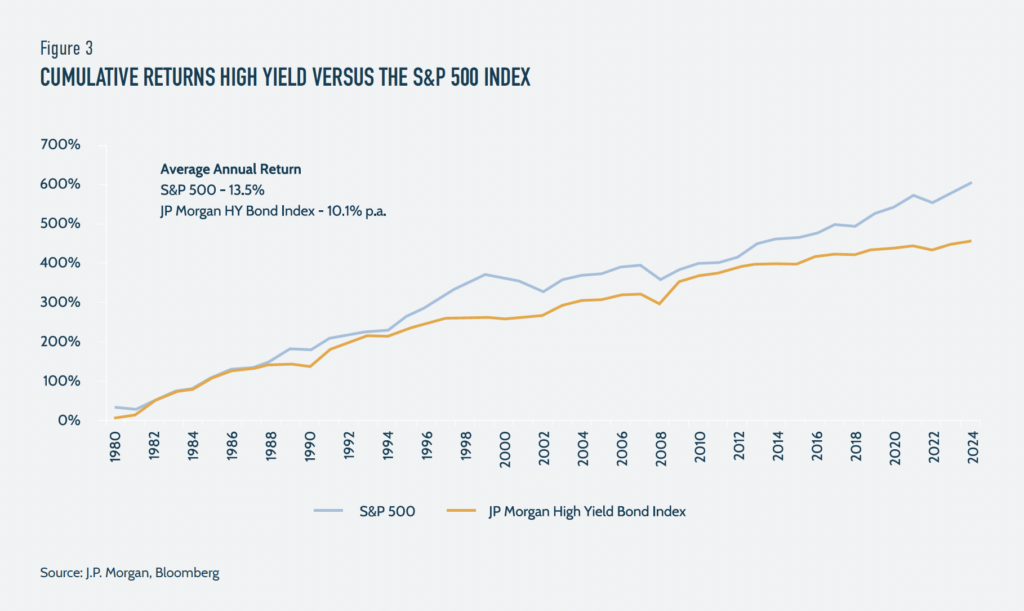

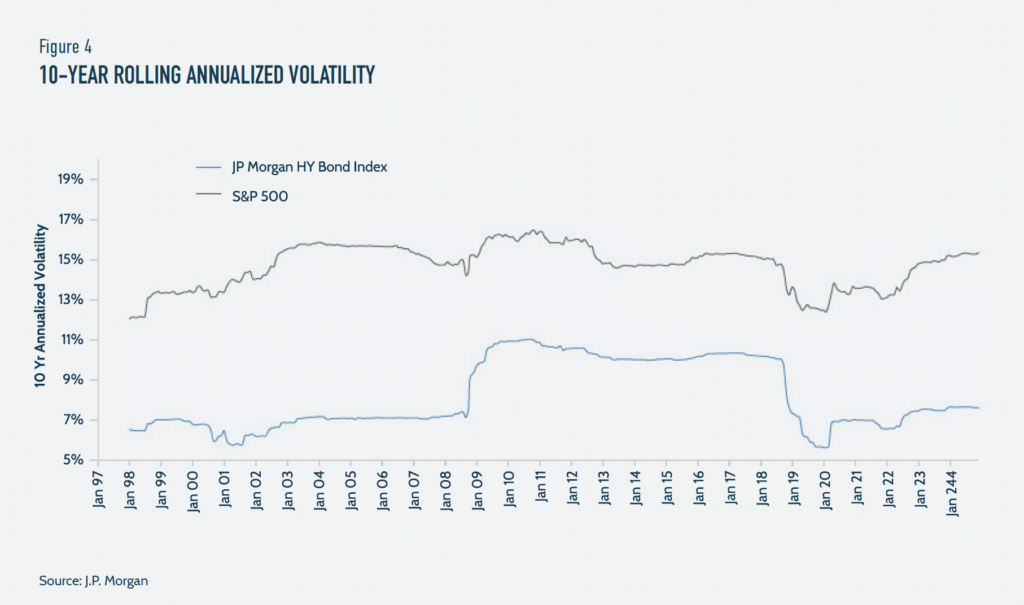

A key benefit of Global Credit is the ability to provide a defensive buffer in portfolios. High Yield has returned ~75% of the S&P 500 with less than half the volatility over the last 45 years. (Source: J.P. Morgan). Leveraged Loans and public Structured Credit provide a secured, floating rate, and liquid source of income allowing investors to reduce their interest rate volatility without compromising their liquidity budget.

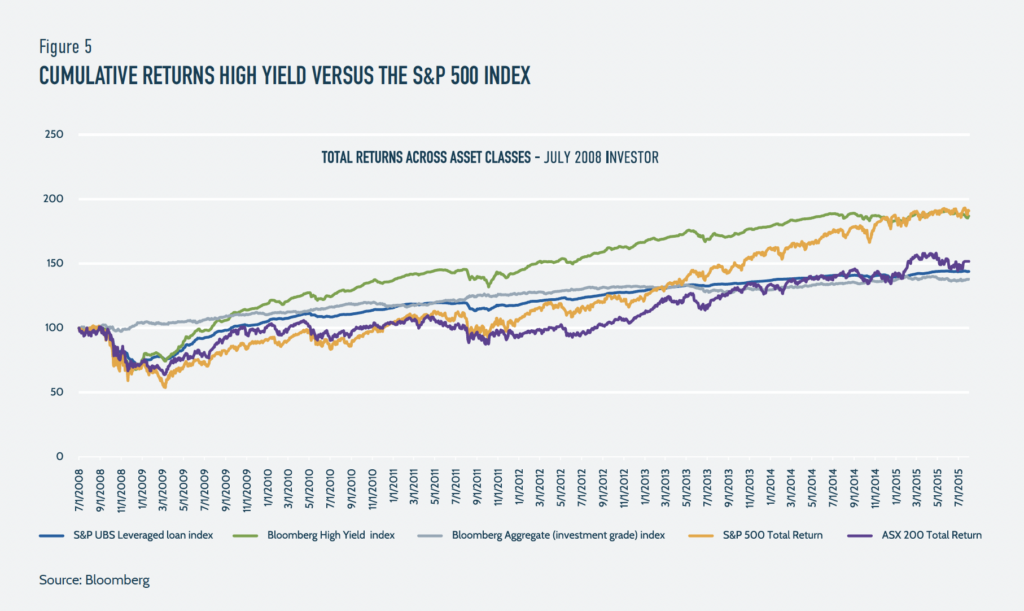

Historically, Global Credit has also experienced lower absolute drawdowns and faster recoveries than equity markets, which in our view highlights its benefit to portfolio construction. Further, reviewing the performance of Global Credit sub-sectors for the five years since July 2008 (just prior to the largest drawdown in credit market history) High Yield returned ~13% p.a. while other credit subsectors delivered midsingle digit returns. By contrast, the S&P 500 achieved absolute returns well below target, with total returns taking ~5 years post the financial crisis to catch the Leveraged Loan market, and ~7 years to catch the High Yield market.

Australians are heavily underweight Global Credit

Australian portfolios have historically been heavily growth-focused and domestic-based. The typical portfolio is highly overweight domestic equities and property with a small defensive holding of cash, Australian fixed income, and private credit (Figure 6). We view this mix to be sub-optimal given the small size of the Australian economy, the multidecade rally in Australian property prices, a highly concentrated domestic equity market, and a rapidly aging population.

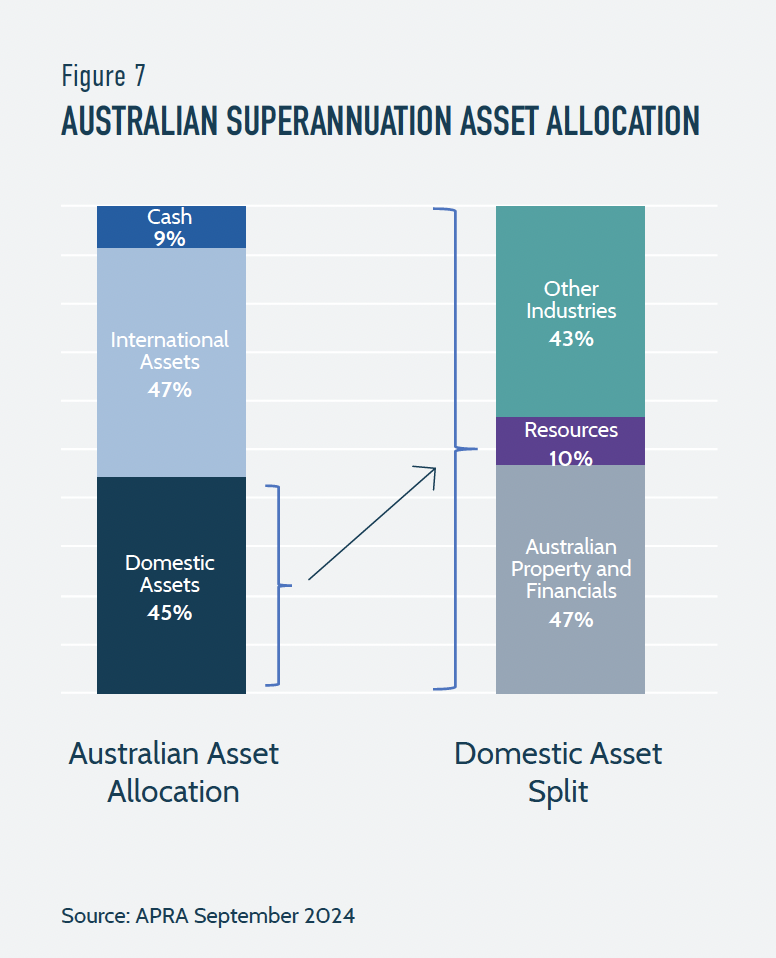

Diversification and liquidity

Diversification remains a key challenge for Australian portfolios. Asset allocation is heavily biased towards the domestic market, with ~45% of total superannuation assets held in Australian assets (Figure 7). While Australia remains an attractive investment destination, the economy is heavily reliant on financial services, property, and resources. As a consequence, ~20% of total assets in superannuation are directly and indirectly invested in domestic property and financials.

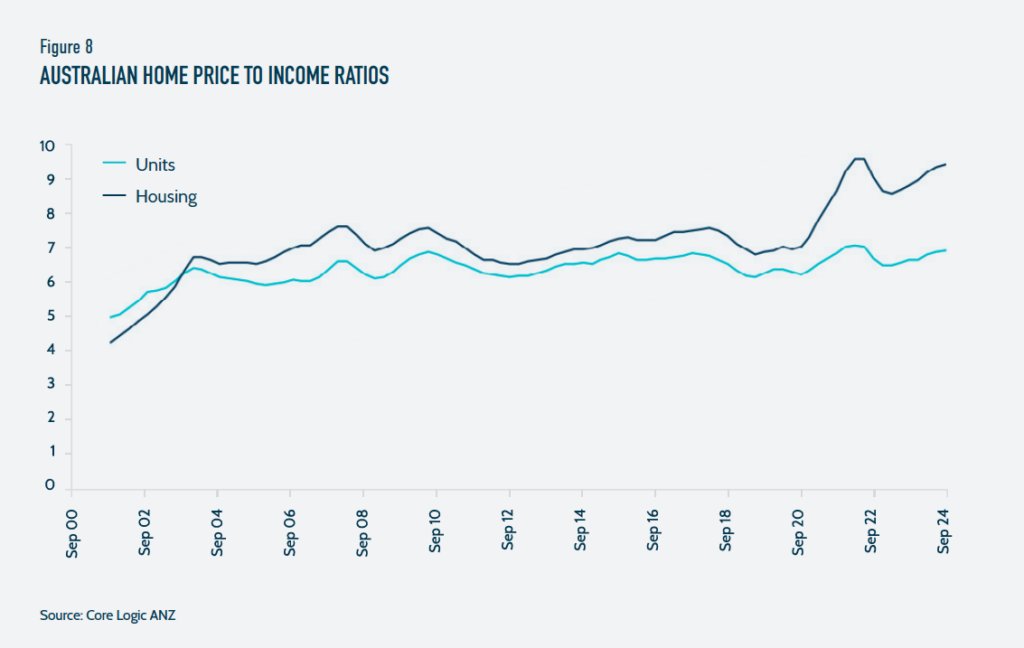

This allocation leaves the average Australian investor highly exposed to the domestic property market across their primary home, investment properties, and superannuation. After a multidecade appreciation in property prices, Australian investors are now more exposed to valuation changes than ever (Figure 8).

In addition, Australia remains a highly resource dependent economy with our financial markets and terms of trade heavily influenced by commodity and agricultural prices. Historically, Australian asset prices have been heavily correlated to commodity prices.

Global Credit is a natural diversifier with property and financials <10%, and commodities accounting for <5%, of the Leveraged Loan and High Yield markets. The other segments of Global Credit provide financials and property exposure outside of Australia, with considerably more issuer diversity.

We observe that the defensive component of Australian portfolios, whilst still small, is becoming increasingly illiquid. Australian fixed income markets are very concentrated in Australian residential mortgage-backed securities which have historically been far less liquid than their US counterparts. The typical tenor of Australian private credit will be anywhere from 3-7 years long and lending is typically bi-lateral or in small syndicates. In addition, Illiquidity premiums across private assets have also been reducing.

While private assets are growing rapidly, as investors attempt to reduce volatility and maintain returns, increasing private asset allocations have resulted in investors sacrificing liquidity and transparency for returns.

In buoyant markets, liquidity tends to be undervalued. The liquidity of Global Credit allows investors to truly invest through the cycle as well as access liquidity when needed.

In summary, allocating to Global Credit provides an attractive portfolio solution allowing investors to increase income, diversify, reduce volatility relative to equities, and maintain liquidity relative to private assets.

Appendix – Definitions

High Yield Bonds – High Yield bonds are public debt securities issued by companies with a credit rating lower than investment grade (i.e. Ba1/BB+ or lower). High Yield issuers are typically established businesses owned by private equity firms or public companies. Whilst features vary, High Yield bonds are typically fixed interest rate instruments with fixed maturities and a range of call protection and prepayment features. They may be first lien secured, second lien secured, senior unsecured or subordinated obligations and typically have a range of incurrence covenants.

Leveraged Loans – A Leveraged Loan is a commercial loan provided by a group of lenders to a company with a credit rating lower than investment grade (i.e., Ba1/BB+ or lower). Leveraged Loan borrowers are typically established businesses owned by private equity firms or public companies. Leveraged Loans are typically secured obligations and have a range of covenants but limited call protection and prepayment features. Interest is usually paid on a floating basis as a “spread” over a base rate (e.g., SOFR, LIBOR, BBSW).

Structured Credit – Structured Credit is a diversified asset class that is generally sub-divided into four categories based on the underlying collateral type: residential mortgage-backed securities (“RMBS”), commercial mortgage-backed securities (“CMBS”), collateralized loan obligations (“CLOs”) which represent a pool of underlying corporate loans, and other asset-backed securities (“ABS”) which are generally backed by credit card debt, auto loans, consumer loans, or esoteric asset classes.

Bank and insurance Capital – Bank and Insurance capital securities are instruments issued by banks (Tier 2 Securities, Additional Tier 1 Securities) and insurance companies (Tier 2, Restricted Tier 1). They are typically subordinated and have equity and debt-like features. These types of instruments typically have longer dated maturities but are callable early and have coupons that are usually “variable” (i.e., fixed coupon until a call date and variable thereafter).

IMPORTANT INFORMATION:

This communication is prepared by Antipodes Partners Limited (‘Antipodes’) (ABN 29 602 042 035, AFSL 481 580) as the investment manager of the Antipodes Global Credit Opportunities Fund (the ‘Fund’) and is intended for wholesale clients only. Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund and is a wholly owned subsidiary of Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). Past performance is not a reliable indicator of future performance and the repayment of capital is not guaranteed. Any opinions and forecasts reflect the judgment and assumptions of Antipodes and its representatives based on information available as at the date of publication and may later change without notice. Whilst Antipodes, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. To the extent permitted by law, Antipodes, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Antipodes.