At Antipodes, we look beyond the headlines and explore less obvious parts of the market in order to find true value and growth. This is particularly important in the market we are currently faced with.

It’s a market relentlessly reaching for structural growth and quality at any price, while cyclical sector valuations have rarely traded on lower multiples.

The reality of persistently low real rates is that the adoption of disruptive technologies accelerates as cheap funding flows to moon-shot style projects with a distant payback – hence, many mature cyclical businesses are cheap for a reason.

But some cyclical stocks may be hiding cheap secular growth opportunities, which could prove lucrative for investors, given how expensive secular growth stocks have become.

A complex conglomerate or irrational extrapolation?

Historically, the market narrative has focused on Siemens as a relatively complex conglomerate unwilling to evolve. However, the pressure for change is building.

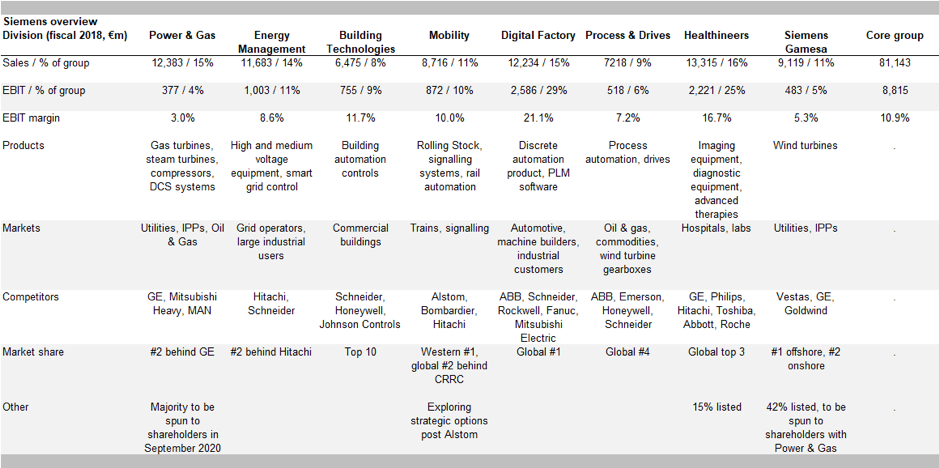

Of Siemens’ nine prior operating divisions, all but two are global top three in their respective industries, most of which are oligopolistic in nature. These high-quality assets have long stood in stark contrast to the low valuation that has been afforded to the equity of the overall group of around 13 times normalised fiscal 2019 earnings.

Siemens holds strong market positions across its group businesses as can be seen here in Figure 3.

Figure 3: SIEMENS DIVISION OVERVIEW

Source: Antipodes Partners, Siemens

Whilst Siemens’ historical growth fixation caused frequent and expensive execution missteps, we would argue the conglomerate discount is now unjustified given the company is actively refocusing1.

Siemens is following the global trend of slimming down its portfolio. It has separately listed its medical equipment business and has committed to spinning off its power business in combination with its renewable energy business. After the rail (labelled Mobility above) merger with Alstom was blocked by the European Commission, we expect this business to ultimately be sold or spun to shareholders.

At the end of this Siemens will generate over half its earnings from the Digital Factory Division.

Multiple ways of winning

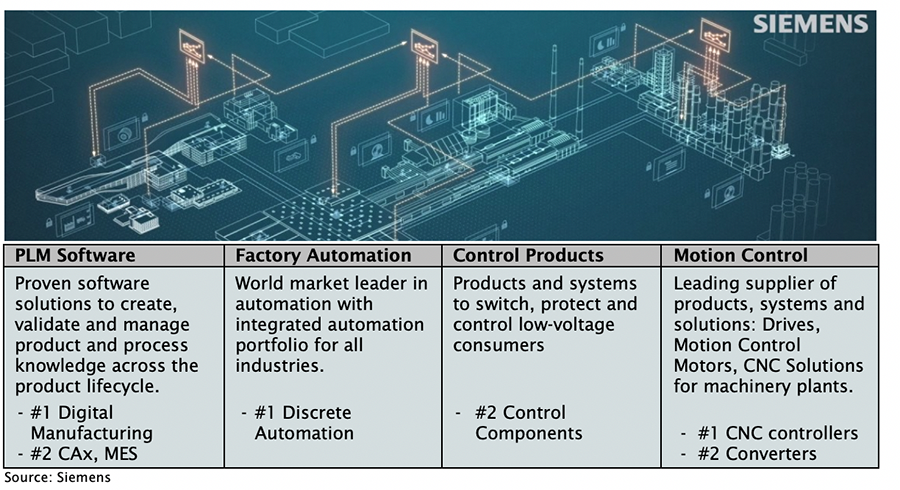

What is Digital Factory?

The industrial process has evolved from steam engine-powered manufacturing plants, to using technology to automate production processes and more recently it’s been about replacing human labour with robots. These stages represent the first three industrial revolutions.

The Siemens Digital Factory division, which has become part of the new Digital Industries segment for fiscal 2019, is a key enabler of the fourth industrial revolution – the full digitisation of the production process from product concept through to mass production.

Siemens is the only player in this field that offers a complete solution with the full integration of hardware and software. Despite the perception that Siemens is slow-moving it was very early in identifying the trend for convergence of software with hardware and began acquiring strategic software assets in 2007.

Its earliest transformative deal was for UGS, a significant company in Product Lifecycle Management (PLM). PLM in its broadest sense is the process of managing the entire lifecycle of a product from concept through to engineering and manufacture, as well as service and ultimate disposal.

Figure 4: PRODUCTS, SOFTWARE & SERVICES OF THE SIEMENS DIGITAL FACTORY2

Since that early foray Siemens has aggressively added capability in complementary areas. In 2016 it acquired Mentor Graphics, whose offering allows the acceleration of design and manufacture of electronic products and systems and which competes with Australian-domiciled Altium. In 2018 it acquired Mendix, which specializes in cloud-native low-code software. These are just the largest two of the many deals which have established Siemens as the leading PLM player.

Testament to the success of this strategy is the stream of customer wins that have since followed. In late 2008 aerospace giant Boeing announced they would standardise all semiconductor and electrical system design, as well as mechanical design, on products of Siemens PLM business.

Mentor Graphics helps semiconductor behemoths Samsung and TSMC to rapidly design, verify and deliver solutions to customers in fast-changing end markets. Another offering allows companies to build a digital twin or an exact digital replica of a product to facilitate testing and value chain optimisation. German automotive giant Daimler uses this offering to test its latest Mercedes automobile models, without the need for physical prototypes.

But it doesn’t end there, Siemens’ Digital Factory software enhances the manufacturing process; everything from designing the most efficient production process, the most efficient plant layout and improving automation. Siemens can design a plant to operate at peak efficiency before it even starts up. The final layer is the data analytics, which monitor the production process to ensure it’s always operating at optimal efficiency.

Secular growth here is the outcome of demographic aging trends that drive the need for productivity gains as workforces decline together with the need for highly responsive and flexible production. Given Siemens’ scale, its rivals find it difficult to compete on R&D investment.

Regarding the other businesses, it’s worth noting Siemens’ healthcare business also operates in a secular growth market with high barriers to entry. And whilst the conventional power business is facing a cyclical challenge of weak demand, gas power is likely to be a key part of the future energy mix as the cleanest and most viable complement to the ongoing build out of renewables.

Macro/Style

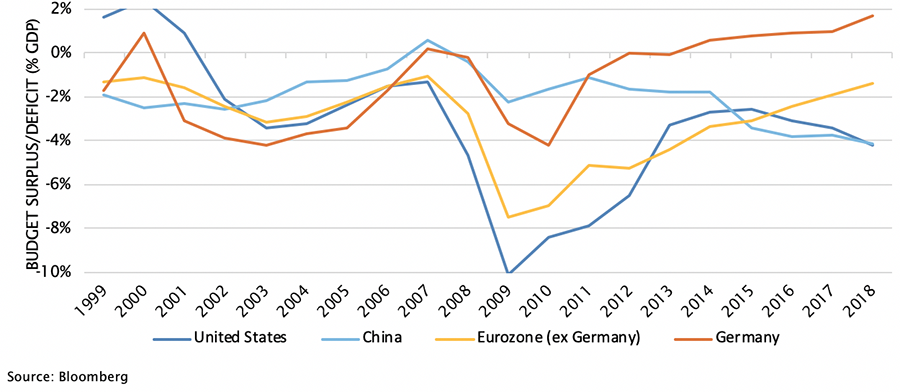

As Figure 5 details, Europe (and especially Germany) has significant fiscal firepower to deploy if it finds a need to. As the slowing global economy, led by trade and industrial weakness, exposes Germany to downside risks we expect the Northern European austerity preference to start to melt in favour of fiscal stimulus. We also expect the incoming ECB President, Christine Lagarde, to leverage her International Monetary Fund experience and political connections to cajole European governments to adopt looser fiscal policy to complement existing loose monetary policy. To the extent that European fiscal stimulus is likely to take the form of social infrastructure investment and the ‘Green New Deal’, Siemens is well positioned to address key areas including industrial/building energy management/automation, renewable generation, electricity grids and rail.

Figure 5: EUROPEAN FISCAL AUSTERITY VERSUS US-CHINA PROFLIGACY

Management and Financial

The current management team – long-serving CEO Joe Kaeser and relatively new Chairman James Snabe, formerly of SAP – appear to have convinced all stakeholders that Siemens’ businesses need to evolve faster. Mr Kaeser clearly has great personal capital with the unions and political stakeholders, whilst Mr Snabe has led a business in a rapidly evolving industry. The two have already delivered significant change with concrete plans to continue to improve growth, margins and cashflow conversion.

Share buybacks make sense when a company has more than enough funds for operational needs and when its stock is cheap. Siemens comfortably meets both these criteria and we expect management to be sensitive to shareholder pressure for more aggressive buybacks.

Margin of safety

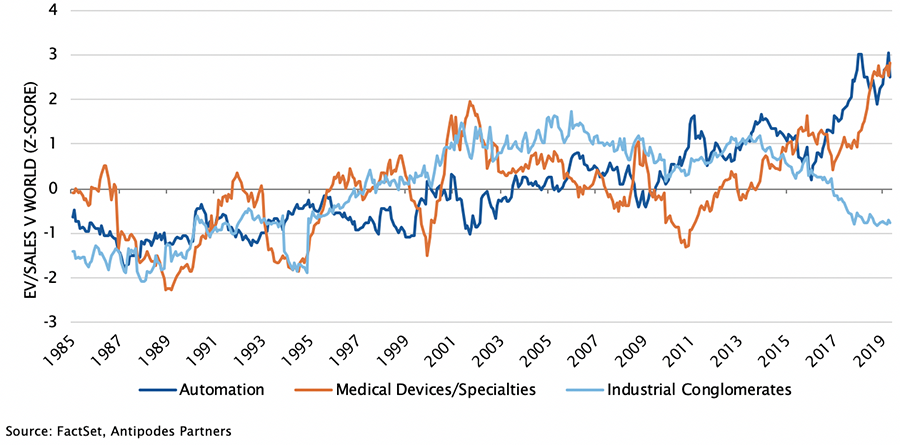

While there are a handful of key competitors in the industrial automation sector, Siemens is the only company to offer a complete end to end solution that fully integrates hardware and software. Figure 6 shows the divergence between the valuation of industrial conglomerates, including Siemens, and pure play businesses in its two most profitable and valuable businesses (automation and medical devices).

FIGURE 6: EV/SALES v WORLD FOR INDUSTRIAL CONGLOMERATES AND SIEMENS’ KEY SEGMENTS

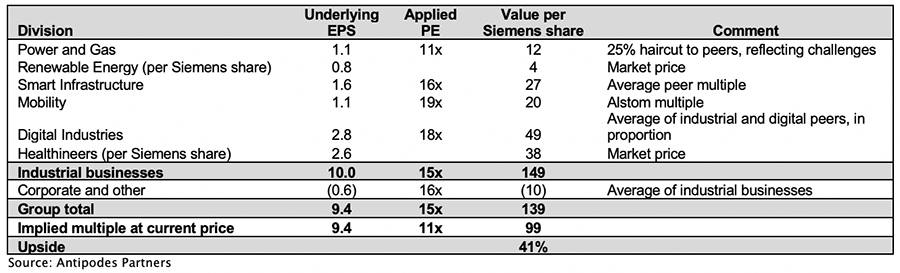

The pure play companies trade at PE multiples greater than 25x, but Siemens trades at around half that multiple because the market sees a big conglomerate. As Siemens continues to slim-down we believe the market will shift its focus to Digital Factory and the valuation gap with the pure plays will likely narrow. As per Figure 7, on simple sum of the parts, we see an upside of around 40% from the current share price.

FIGURE 7: SIEMENS’ SUM OF THE PARTS

The risk to our case is that as the global industrial economy continues to slow, and trade and Brexit uncertainty persists, Siemens’ short-cycle businesses (which includes parts of Digital Factory and accounts for roughly a third of earnings) will suffer headwinds as capital spending budgets are cut.

Notwithstanding this, we would argue that Siemens is somewhat already priced for a recession. The company’s current price earnings multiple of ~12 is significantly lower than many of its listed peers which are still extrapolating secular growth.

In this sense, Siemens is a great example of finding quality and growth in a less obvious part of the market.

1The case for de-conglomeration can be made if it results in greater focus and accountability to shareholders and reduces counterproductive competition for resources amongst disparate businesses.

2PLM software refers to software used in Product Lifecycle Management, CAx refers to computer aided technologies, MES refers to Manufacturing Execution Systems and CNC refers to Computer Numerical Control used to control machine tools