The past decade has been anything but smooth sailing for pharmaceutical giant Merck & Co.

Among the more notable events, the Vioxx drug scandal (2004-15) and the Cubist acquisition (2014/15). These missteps arguably destroyed more than $10bn in shareholder value.

Over the same period, growth in Merck’s core pharmaceuticals business was evaporating. It had outsized exposure to increasingly competitive drug classes (heart failure, diabetes), a heavy cost base and an uninspiring pipeline. Poor execution by management has been a reoccurring theme and the main reason why the company had, for long periods of time, traded at a discount to peers.

There is however a major transformation materialising. Beginning in 2013, Merck divested its consumer business, materially reduced headcount and made a big bet on Keytruda, a cancer drug it nearly abandoned after acquiring Schering-Plough in 2008.

Initially, Merck’s Keytruda was behind in the race to commercialise a new class of cancer drugs called ‘checkpoint inhibitors’ or ‘immuno-oncology’ drugs (which act by enhancing the immune system’s ability to recognise and destroy cancer cells). Given Merck’s past missteps, market scepticism of management’s bet on Keytruda was arguably fair, especially as it faced worthy competitors in Bristol-Myers Squibb, Roche and Astra Zeneca, on top of Merck’s negligible presence in oncology at the time.

Today, however, that bet on Keytruda is delivering in spades thanks to solid clinical trial execution and setbacks at rival Bristol-Myers Squibb. Merck, as a whole, is also a significantly leaner company.

Irrational extrapolation

While we believe Merck is now a far superior business than it was before its transformation began in 2013, there are four issues which have dominated the narrative over the last few years. Issues which we believe have led to irrational extrapolation by the market.

- A ‘melting ice cube’ base business

Merck’s leading oral diabetes drug Januvia, a drug with $5-6bn in annual sales or ~15% of revenues, faced pressure from direct competitors and a new class of oral drugs which emerged with impressive results. As data surfaced showing a clearly superior profile to other drugs in its class, while the new class of drugs were largely being used by patients after they stopped responding to Januvia, market concerns over Januvia were overdone.

- The ‘immuno-oncology’ drug race

The key immuno-oncology battle being fought was in late stage lung cancer. In the US lung cancer is the second most common cancer (~225,000 new cases annually) and is the leading cause of death by cancer each year (~155,000 deaths per annum). While difficult to predict winners in these situations, there were subtle signs of Merck’s strategy creating an edge. With a growing lead, the moat is growing wider around Keytruda. Meanwhile Merck’s leading Vaccines and Animal Health businesses (almost one-third of sales) was strengthening and being overlooked.

- Drug pricing risks in the US

US history is littered with failed attempts to reform drug pricing thanks to powerful industry lobbying. But growing bi-partisan support for reform has created a palpable undertone of ‘this time is different’, causing a protracted period of underperformance for pharmaceuticals shares. Legislative and legal hurdles remain high, however, and Merck’s relatively shielded position, via its drug pricing strategies and its insulated Vaccines and Animal Health businesses, is underappreciated.

- ‘Patent cliffs’

Patent cliffs are a sad fact of life for biotechnology and pharmaceuticals businesses (and investors). This refers to the situation when patents protecting a drug from competition expire and multiple competitors enter the market with ‘generic’ or copies of the drug.

While the US patent for Merck’s diabetes drug Januvia expires in 2022, Merck is better placed relative to peers facing similar patent expiries, as it is set to grow through the period. By the time Januvia’s patent expires we estimate the drug will be less than 5% of Merck’s revenue and Keytruda is on track to become the highest selling drug in history.

With a premiere R&D engine in Merck Research Labs, it has the foundation and time to build a pipeline of new drugs before Keytruda faces a potential cliff in 2028.

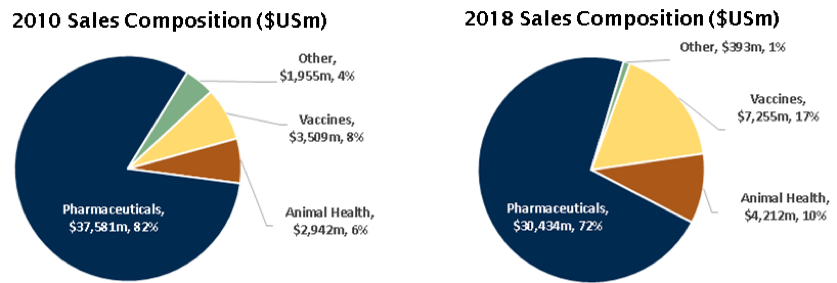

Merck’s revenue mix has become more defensive.

Multiple ways of winning

Competitive dynamics & Product cycle

Merck has employed an aggressive, well-hedged development strategy for Keytruda based principally on outspending competitors. The result is a “wall of data” being generated from more than 600 trials studying Keytruda combined with other drugs and more than 100 early-stage cancer trials, dwarfing its competitors.

These studies are mostly ‘adaptive design’ which means they can be quickly ramped up in the event a competitor’s drug or combination shows enticing results. Given its leading position, smaller biotech companies now prefer using Keytruda as the backbone to combine with new cancer drugs they are developing to provide the best chance of commercial and clinical success.

While a controversial topic, our interpretation of the clinical evidence to date suggests Keytruda’s mechanism of action may be delivering superior outcomes to competitors’ drugs. This hypothesis is supported by the fact that nearly all ‘fast-following’ Chinese biotechs are developing drugs which have the same target as Keytruda as opposed to those drugs from Roche, Astra Zeneca and Merck KGaA, which have a slightly different target.

The opportunity for Keytruda is much bigger than the market realises. Sales outside the US are set to accelerate as reimbursement broadens through Europe, Japan and China. Precedent suggests oncology drug sales outside the US can be 1.5x US sales. Margins are also on the precipice of a major inflection following years of heavy R&D and sales force investments which will begin to normalise at the same time Keytruda’s global launch profile accelerates.

Keytruda’s R&D costs, representing roughly half of Merck’s current $8.6bn R&D budget, are peaking and will begin to decline over the next few years as major clinical programs for Keytruda complete. Precedent shows margins can inflect materially off the back of a dominant product franchise (think AbbVie’s Humira) and in Merck’s case it will likely exceed precedent with the aid of its human papilloma virus (HPV) vaccine, Gardasil.

Gardasil is now a ‘must have’ vaccine given the growing evidence showing it prevents cancers in later life including cervical, genital and head & neck. As the evidence has emerged, demand has grown at an unprecedented rate as governments around the world implement broad vaccination programs in boys and girls with some funding catch-up programs in adults – but we have barely scratched the surface given less than 3% of the world’s eligible population has been immunised. Onerous technical and financial barriers to entry exist with vaccine development, and exposure to drug pricing risk is minimal making this an attractive, resilient business. Gardasil is also a highly profitable product.

Merck’s Animal Health business is one of the largest globally. Its customer base is sticky and barriers to entry are high. Merck has the option to continue building this leading global business or exit it, which could unlock more than $40bn in value. With a nascent aquaculture opportunity (fish/seafood farming), population and middle-class growth in developing markets, and a strong consumer driving companion animal product demand, we suspect more value will be created longer-term.

Regulatory

Political risk is real but is being overstated as it relates to Keytruda. Merck’s strategy to price Keytruda only modestly higher in the US versus the rest of the world makes it relatively insulated to some of the proposals targeting high drug prices in the US. Furthermore, sweeping reforms of drug pricing structures in the US would require legislative change, meaning broad bi-partisan support as a prerequisite, specifically in the US Senate. On balance we see the risks here stemming from headlines which are transient as opposed to lasting structural change.

Management and Financial

Current CEO Kenneth Frazier (appointed in 2011), a lawyer by trade, started at Merck in 1992. Mr Frazier recently communicated his intention to retire and the search for a new CEO has commenced.

Mr Frazier has, until now, overseen some of Merck’s more testing days, and we see the CEO change as a positive development potentially opening the door to more shareholder friendly actions and a new chapter with the opportunity to appoint a leader with more medical/scientific credentials.

Irrespective of one’s view of who wins the immuno-oncology race, Merck is well positioned for the next decade. By 2023 the business will have completed a major capital expenditure and restructuring program, the benefits of which are not widely discussed by the market. The balance sheet is de-leveraging rapidly, providing ample fuel to feed Merck’s premier R&D engine and/or invest in its Vaccines and Animal Health businesses to underpin the longer-term growth outlook.

While burgeoning healthcare budgets pose a longer-term headwind to pharmaceuticals businesses, innovation and diversity of earnings provide insulation. Merck’s degree of resilience is uncommon amongst its large biopharma peers.

Style and Macro

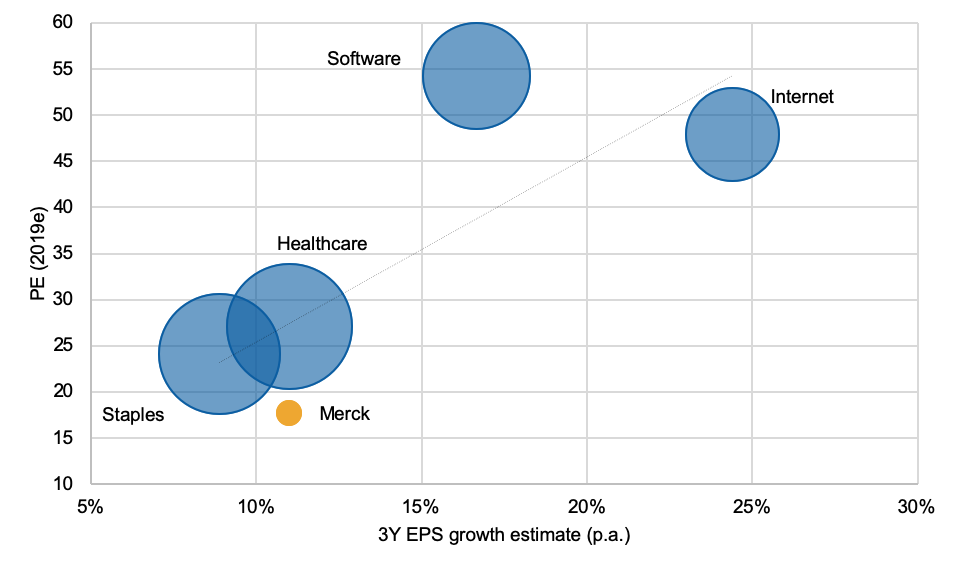

Throughout this protracted period of low rates and concerns over global growth, investors have been paying increasingly higher multiples for businesses with defensive and structural growth qualities. Merck represents an attractive way for investors to gain such style exposure, that is, adding a cheaper expression of quality to portfolios.

Margin of safety

While Merck faces many of the same risks as its peers, we view it as a far superior business given the diversity of its revenues, the leading advantage Keytruda has built and visibility of earnings in the medium-term.

The drug pricing overhang in the US has created an opportunity to invest in Merck shares. Merck is a company with defensive growth and quality attributes, at an attractive valuation. Businesses with similar defensive and structural growth qualities are trading at significantly higher multiples, many of which have less attractive growth rates and arguably higher exposure to any emergence of macroeconomic malaise.

Merck v healthcare, staples, software and internet industry