Finding attractive value in one of the world’s biggest companies might seem unusual for a value investor and to many Microsoft may seem expensive.

However, we’d argue that the rerating is justified given the tech giant is currently experiencing one of its most rapid periods of growth in its 44-year history with a long runway ahead.

Conversely, we also believe in a similar manner to 2000, the general ‘bubble’ in duration or growth valuations means there is a great opportunity to short some of the weaker so called ‘best of breed’ SAAS companies that fall in Microsoft’s crosshairs.

Microsoft has virtues across all layers of computing. Its core strength is the way the company’s service offerings and platforms work together seamlessly (often with 3rd party software), adding large value for users.

Microsoft’s ‘Office 365’ and ‘Windows 365’ bundles are aimed at around 677 million office workers in countries classed as either ‘high income’ or ‘upper-middle income’ (excluding China). For these workers, using software to replace paper-based processes makes strong economic sense.

Antipodes estimates around 500 million office workers will need to use a broad software suite at some point in time. Around 180 million currently pay for the Office 365 bundle and around 20 million use Google’s equivalent, G-suite. It’s thought a further 300-400 million use either on-premise Microsoft Office or a pirated version.

The Office 365 power play

Microsoft is working to capture as much of the customer wallet with its Office 365 offerings. Office 365 has become a powerful suite that bundles Microsoft’s SaaS (software-as-a-service) software into a single product – powering desktops, laptops and mobile phones.

Most bundles include the essential Microsoft document creation software (Word, Excel, Power Point), along with communication tools (Outlook, Teams, Planner, OneNote, Skype for Business), storage services (OneDrive), analytics (PowerBI) and more.

After being developed in 2017, the ‘Microsoft Teams’ application is becoming the default operating system which brings all of these apps, and apps for third party developers, together in a single whole-of-office (or team) workflow.

A full-featured Office 365 bundle with security features costs US$35/month or US$20/month without security. More basic versions go down to about US$10/month.

The most comparable bundle is G-Suite from Google which is still priced at a premium – US$25/month for full suite without security and US$12 for the equivalent to Microsoft’s US$10/month product. G-Suite arguably lacks many of the capabilities found in Teams, Active Directory, Analytics and other Microsoft products.

Gartner estimates Microsoft has an 88% share of the productivity market, with Google on 10%. In fact, the biggest competition is between Office on Premise and Office 365! This leaves just 2% of the market for SaaS alternatives.

‘Nosebleed’ alternatives under pressure

To produce an alternative bundle to match Office or G-Suite, one would be required to operate a collection of ‘best-in-breed’ SaaS offerings.

It would look something like this:

Slack (Teams alternative)

Smartsheet, Airtable, Quip or one of many other start-ups (Word, Excel, Powerpoint)

Dropbox (OneDrive, SharePoint)

Zoom or Ring Central (Skype for Business, Teams)

Front (Outlook, Exchange)

Symantec (Windows Defender)

Looker (Power BI)

Trello (Planner)

Okta (Active Directory)

We estimate the cost of a collection of these stand-alone services is about US$80/month and we think we’re being generous; Zoom alone costs $20/month, more than half the cost of the entire Office 365 bundle. It also comes with the complexity of having more vendor relationships, and software that has weaker integrations vs the simplicity of dealing with Microsoft or Google.

Regardless, many of the above companies trade on nosebleed valuations.

Microsoft Teams launched in late 2017, four years after Slack (an alternative collaboration application) and has already overtaken it with over 12m daily active users. Despite this Slack currently trades on 26x sales.

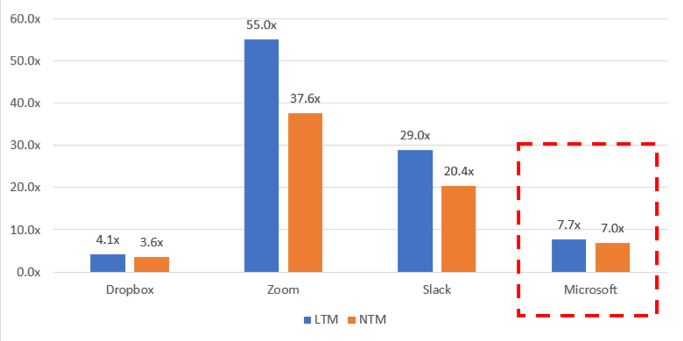

Zoom (a voice and video communication alternative to Skype for Business) trades on 47x sales. This is compared to Microsoft’s EV/Sales valuation of 7.7x.

Enterprise Value / Sales

Source: Antipodes, Factset, Sep-19

Slack and Zoom are clearly ‘high-flying’ stocks that trade on such high valuations because they’re expected to carve out decent slices of their respective markets.

We believe the market has been getting this wrong and recently we’ve seen many cloud SaaS names being aggressively sold off as more questions are asked about their terminal profitability.

The fact Microsoft’s bottom line margins are outperforming even top-line growth is reassuring the market and has ensured material recent outperformance vs higher growth but loss-making peers.

All the features offered by Slack and Zoom are available for near zero incremental cost in a Microsoft or Google bundle. Our belief is the bundles from Microsoft and Google will ultimately win dominant market share over these high-flyers due to greater scale, greater distribution, simplicity of using one vendor and a superior bundled price versus value proposition.

The bundle domination thesis has precedent in file storage and synchronisation. Microsoft (and Google) responded to the domination of Dropbox several years ago, introducing a storage product into their bundle. Total Dropbox users are now shrinking. The company’s valuation has dropped from 15x sales in 2018 to 5x sales at time of writing.

What could happen to Zoom and Slack’s multiples with Microsoft and Google’s increased focus?

A tech giant beginning to flex its muscles

Microsoft can use bundles to keep pricing very attractive compared to stand-alone products, which must rely on claiming to offer ‘best of breed’ services.

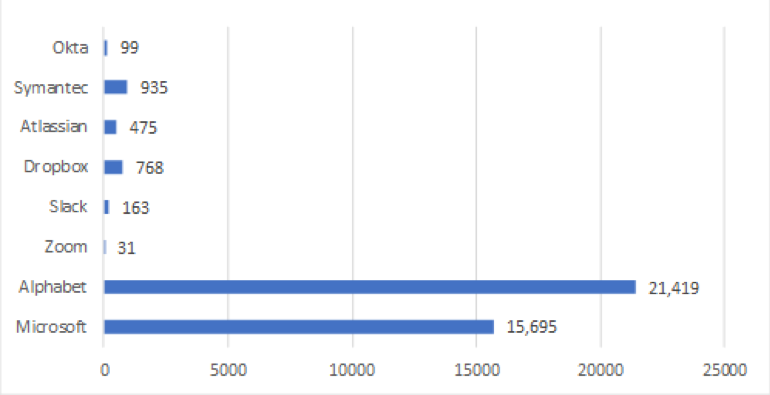

But it’s hard to see SaaS alternatives sustainably maintaining superior products. Like Google, Microsoft has an unparalleled research and development budget that should negate any specific product feature weaknesses over time.

Research & Development Spend – 2018 (US$m)

Source: Antipodes, Factset

Microsoft wasn’t well positioned 8-10 years ago when most of the stand-alone SaaS ‘high-flying’ competitors were founded. This has, however, changed since Satya Nadella became CEO in 2014. Since then, Microsoft has been incredibly focused on developing SaaS capabilities in the core Office applications and started to compete strongly in new areas like collaboration, storage and planning.

The company is also using its established platforms to push into new areas.

The ‘Dynamics 365’ bundle integrates CRM, Marketing, Services, Financials and HR onto one common system and workflow. Dynamics 365 is attractively priced for most businesses and should grow to become a serious threat to traditional, well-known alternatives in the SMB space such as Salesforce, Zendesk, Hubspot, Atlassian and Xero.

Overall, we think the valuation proposition Microsoft brings to all businesses is increasingly based on a compelling package or ‘bundle’ of services that will be very hard, if not impossible, for single product vendors to replicate.

Microsoft has been a top 10 position for Antipodes since inception and we continue to think the company is well positioned for unforeseen changes in technology trends going forward, largely due to its recent cultural change, strong sales force and bundling capabilities.

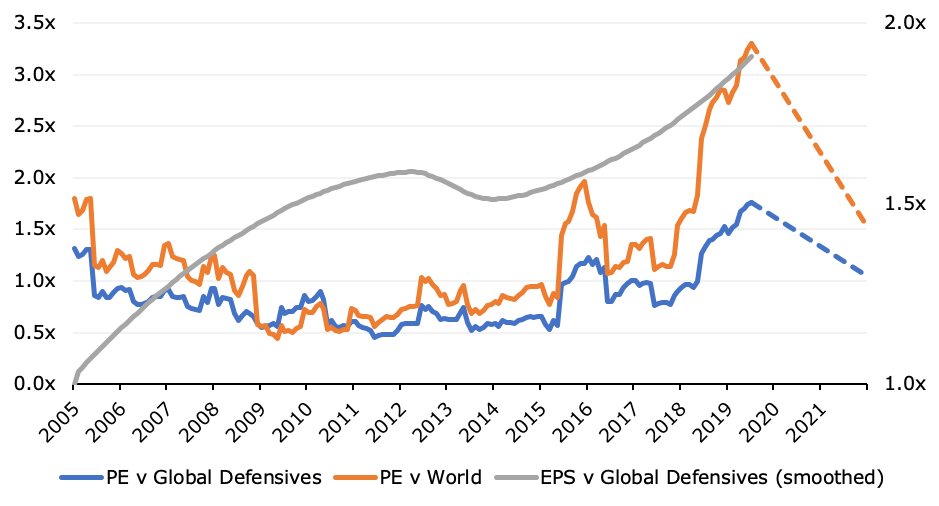

The chart below captures Microsoft’s rerating against the broader market and also against the ‘defensive quality growth sectors’ – the aggregate of the global Software/Internet, Consumer Staples and Healthcare Sectors.

The third line captures Microsoft’s growth against that peer growth. In summary, Microsoft trades at the average peer group multiple but is growing and we believe will continue to grow at twice the peer group average – at the very least Microsoft is an ‘inexpensive’ defensive, growth opportunity.

Microsoft – Relative PE and EPS Growth

Source: Antipodes, Factset

The Antipodes pragmatic value approach seeks quality and growth in less obvious parts of the market. This means we’re happy to invest in a company like Siemens, perceived to be cyclical but with businesses well positioned for secular growth opportunities in social infrastructure, alongside something far more ‘obvious’, but nonetheless potentially overlooked in terms of its durability in Microsoft.