16 August, 2021

As the Delta variant spreads, markets have become concerned about the potential for COVID-19 to once again put the brakes on economic growth.

But our analysis shows ‘Delta fear’ could peak over the next few weeks.

As Delta quickly spread through the UK, we noted hospitalisation and fatalities were the statistics to watch rather than infection rates alone given vaccination progress in the northern hemisphere. Pleasingly vaccines have broken the link between infection and fatalities – daily infection counts have recently halved in the UK, and Delta/COVID related hospitalisations, ICU occupancy and fatalities are reverting to trough levels.

The US appears to be following a similar pathway to the UK, meaning case counts will escalate in the near term but could peak by late August or early September, particularly when accompanied by a drive to lift vaccinations and other measures like vaccination passes.

85% of UK adults have received at least one dose followed by 60-65% in Europe and the US. And with such rapid transmission as seen with Delta, population immunity will likely be naturally boosted after its passing, making future waves potentially less impactful.

Meanwhile, emerging markets are catching up quickly, this remains central to a global pathway to herd immunity and cross border reopening beyond regional travel bubbles. More than 50% of Brazilians and 30% of Indians have now received their first dose.

So, while a new element of fear has returned – more widespread lockdowns, particularly in the northern hemisphere are highly unlikely given the progress in vaccination rates and the success vaccines have had in preventing severe disease and fatalities.

The Lambda variant has also started to gain global attention, but this variant was first detected over a year ago and has not risen to dominance. The real-world data shows Lambda may not be as virulent as Delta and existing vaccines appear to be just as effective preventing severe disease and death.

Given the nature of COVID-19 more variants are likely to come, but so far, the data shows existing vaccines are providing strong protection.

Delta’s impact on global equity markets

Growth and Defensive sectors have outperformed the more economically sensitive Value and Cyclicals for the last two to three months – and more recently this has been driven by a resurgence in concern over economic activity.

In fact, Value and Cyclicals have given up most of their year-to-date outperformance.

But the extent of this recent cyclical drawdown and move in long bonds, goes against our analysis (outlined above) that the Delta variant is unlikely to be a headwind to reopening in countries where vaccines are well-progressed, and also contrasts our view that 2021 does not represent the end of the economic cycle.

Economic growth can extend on the extraordinary stimulus we’ve already seen and strength of household balance sheets.

Our conviction around a normalisation in yields (driven by increased economic activity) and rotation back into relative value stocks is strengthening.

The time to pivot portfolios further towards reopening cyclical themes like autos (pent up demand and cashed up households), travel (notably Europe/EM) and investment stimulus themes like compute and decarbonisation is arguably approaching.

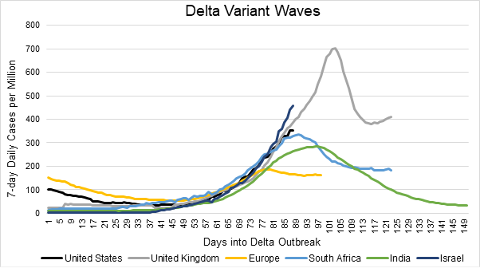

But look outside the US

US equities have never been more expensive in an absolute and relative sense in the last 25 years.

Today, US equities are 65% more expensive than the rest of the world, which is as extreme as the premium has been. And this is despite little difference between the long-term earnings growth profile of US companies versus the rest of the world.

In recent history US equities have benefited from Trump tax cuts and outsized fiscal stimulus, but these are one-off factors that don’t justify today’s premium. With record high government debt and a fiscal deficit of 13.5% of GDP, we have to question whether there is much gas left in the tank.

The US is also home to big-cap tech, so it has disproportionately benefited from secular trends like software and the cloud.

US equities account for around 60% of the global index, but the extraordinary premium for US equities is unlikely to be as sustainable as many believe.

Emerging investment super cycles around decarbonisation, 5G and infrastructure benefit companies globally, not just in the US. Northern Europe and Asia’s stronger fiscal positions mean those economies are in a better position to kickstart these investment cycles and emerge with a durable recovery.

3 charts in focus

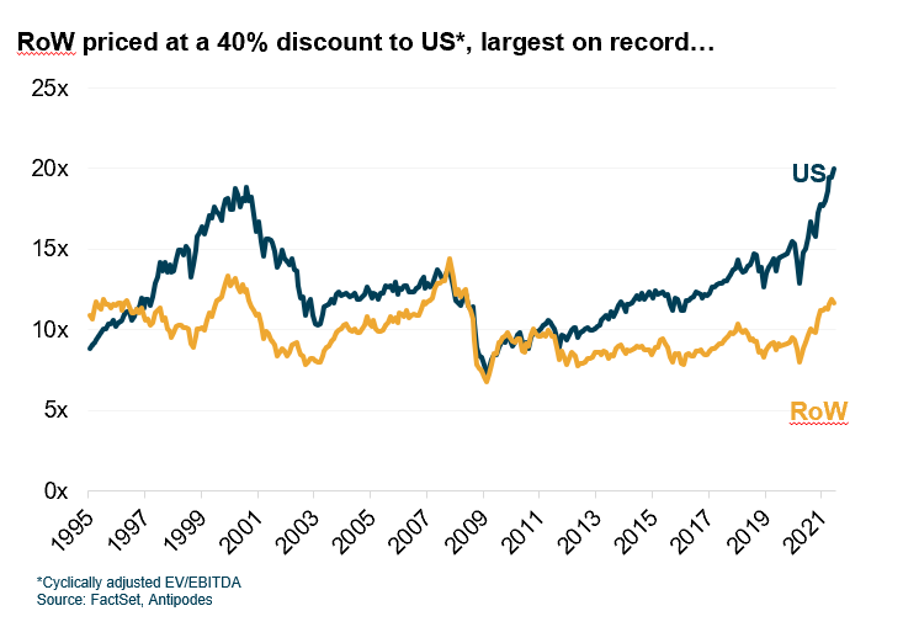

Delta

The UK Delta experience (grey) shows numbers are likely to get worse in the US in the coming weeks (black) and we could be entering a period of ‘peak fear’ in the US. Given widespread lockdowns are unlikely, a further sell-off in cyclicals could present a compelling buying opportunity.

Source: ourworldindata, Antipodes Partners Analysis

Value’s discount to growth

Value’s discount to growth has rarely been this attractive. You can also see how small the much-hyped ‘market rotation’ earlier this year was. This chart captures the extraordinary runway ahead for the types of equities that fall into our pragmatic value style.

US vs The World

A picture of why we’re cautious on the US market and extremely constructive on leading businesses in Europe and Asia that are currently not afforded the same lofty valuations.