The healthcare sector is renowned for its dominant drug franchises, pricing power, consolidated distribution and predictable customer (patient) base but has noticeably lagged the broader global market for the past three years. We anticipate healthcare related businesses will continue to be pressured by governments grappling with affordability given decades of high industry cost inflation.

But within the sector we like biotechnology leader Gilead Sciences for its historically high market share in HIV treatments and promising new targets emerging in the pipeline.

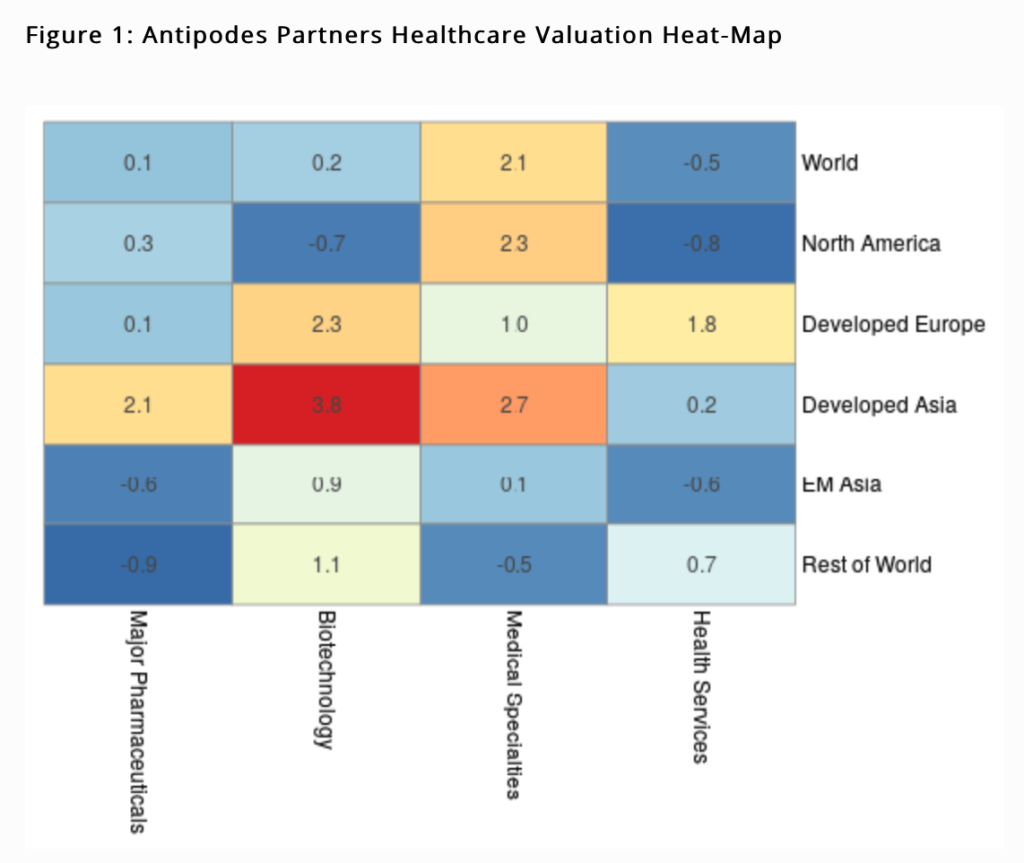

The Antipodes Partners Healthcare Valuation Heat-map provides a more granular illustration of valuation clustering across healthcare related industries and regions. Cell colouring indicates the degree to which an industry’s Enterprise Value (EV) to Sales multiple relative to the world is above or below its 22 year trend (expressed as a Z-Score, the number of standard deviations from the mean). The warmer the colour, the greater the relative multiple versus history; vice versa for the cooler blues, with extremes highlighted by the boldest of colours.

With its deeper subset of stocks compared to Western Europe, the North American Biotechnology sector indicates good value, whilst the Major Pharmaceutical sector across most regions is broadly cheap to very cheap. Gilead Sciences has been a top 10 portfolio holding since inception and whilst it hasn’t paid off to date, multiple tests of the investment case led us to recently increase our position.

Irrational extrapolation

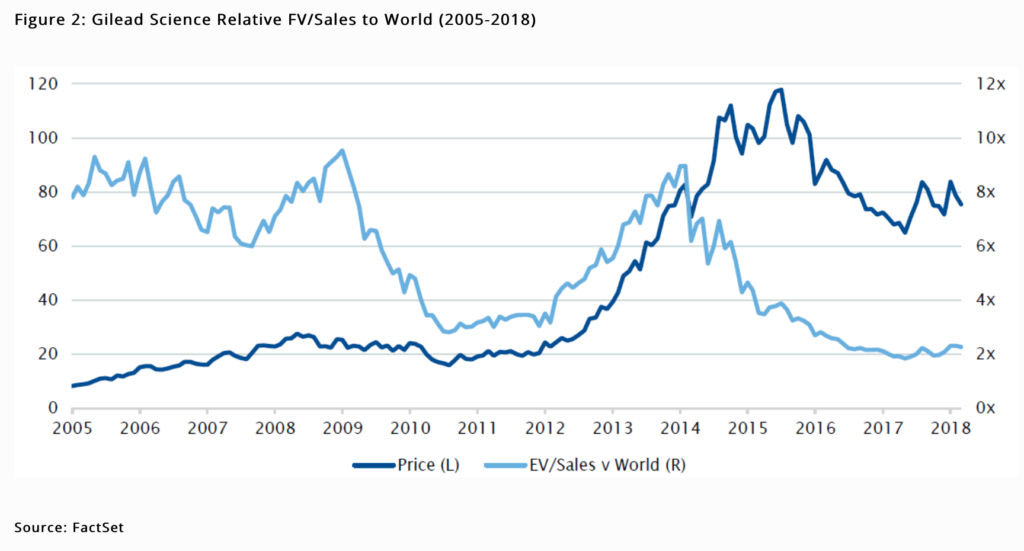

Gilead’s stock rose to spectacular heights following its acquisition of Pharmasset in November 2011, which enabled development of the Hepatitis C (HCV) blockbuster drug Sovaldi, only to collapse from mid 2015 as pricing fell sooner than expected and the curative nature of the franchise led to a sharp fall in patient starts. We think the market’s preoccupation with the slope of the HCV run-off has obscured appreciation for the resilient HIV franchise and developing pipeline of new treatments. Further driving pessimism has been the healthcare affordability factors mentioned earlier and vulnerability to politicisation as government electoral cycles frequently roll around.

Multiple ways of winning

Predictability of the HCV franchise earnings has improved with stabilisation in patient starts whilst becoming much less significant to the overall investment case. As featured in figure 4, HCV share of total sales is set to fall from a peak of nearly 60% in 2015 to roughly 20% by 2020. Until then the franchise will likely generate cumulative free cash flows exceeding $6bn.

Since first receiving human immunodeficiency virus (HIV) treatment approval in 2002, Gilead has grown to dominate HIV globally with up to 80% market share in the U.S. and around 50% internationally. In the U.S. HIV remains one of the few therapeutic areas where public funding is preserved under the 1990 Ryan White Comprehensive AIDS Resources Emergency Act. The social consequences of increased prevalence of HIV in society are too great for government to ignore or exercise formulary exclusion given potential drug resistance issues as recently evidenced by President Trump’s proposal to cut the National Institutes of Health’s funding by 19% (HIV/AIDS funding was not impacted). The unfortunate tendency for the disease to develop resistance over time helps Gilead’s leading innovation to sustain protection from competition. In February 2018, Gilead’s bictegravir (now Biktarvy) was approved by the FDA for treatment of the HIV-1 infection and is under EU review. The new drug is expected to be “strongly additive” to the existing HIV franchise and help compensate for older therapies due to come off patent. Physician feedback suggests Biktarvy is likely the “go to” medicine for treatment naïve patients, with many having drug resistance concerns for GSK’s Juluca doublet regimen. Biktarvy Phase III data recently showed a superior safety profile with 8% drug related adverse events (headache, nausea, insomnia) vs 16% for GSK’s Triumeq.

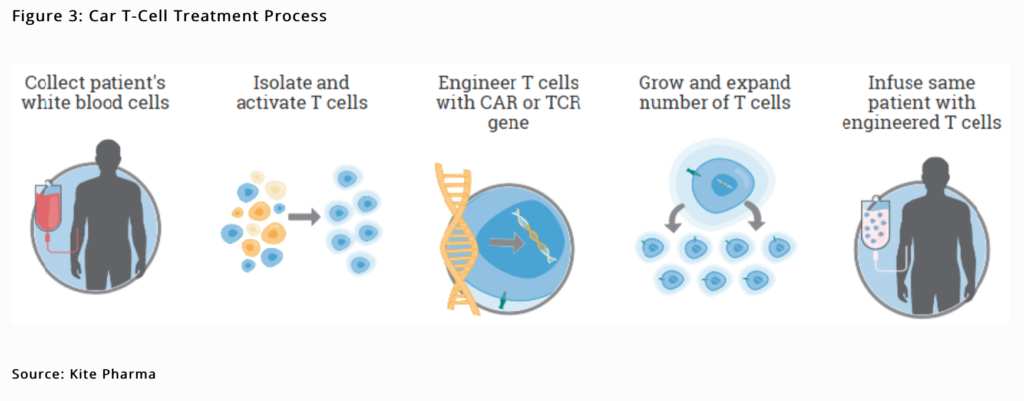

Gilead has a demonstrated ability to buy late-stage assets, gain approval and build drug combinations with superior efficacy that can dominate therapeutic areas. After a six year hiatus since acquiring Pharmasset for $11bn, Gilead struck again in August 2017 paying $11.9bn for Kite Pharma. Kite is an industry leader in the emerging field of cell therapy. Chimeric antigen receptor T-cell therapy commonly referred to as CAR-T can remarkably reprogram the body’s own immune cells to recognise and kill cancer cells (Figure 3). Cell therapy has generated compelling clinical data in cancer patients for whom all other treatments have failed. Kite’s lead CAR-T therapy candidate Axi-Cel was approved by the FDA in mid-October, six weeks early and is under expedited review in the EU. Called Yescarta, it is only the second approval of a CAR-T therapy by the FDA (after Novartis’ Kymriah in August 2017) and the first for the indication of DLBCL, a form of lymphoma cancer. Whilst controversial, the $373,000 proposed list treatment price is in line with expectations and ICER (an independent clinical and economic review group) did a public review of CAR-Ts and recommended both Kite’s Yescarta and Novartis’ Kymriah as being cost effective, suggesting pricing is in line with their clinical benefits over a lifetime horizon. The efficacy data is impressive as per Kite’s ZUMA-1 pivotal trial where 72% of patients treated with Yescarta responded to therapy including 51% of patients who had no detectable cancer remaining, i.e. complete remission. Research continues on further indications, including solid tumour potential, which would be a medical game changer.

With the addition of Car-T, Gilead’s development pipeline is deservedly getting more investor attention. Both NASH (non-alcoholic fatty liver disease) and Filgotinib (rheumatoid arthritis and Crohn’s disease) are currently in Phase III and Phase II stages respectively. For both, key data readouts are due next year and could potentially start generating revenue from 2020 as prospective $2bn+ drug franchises.

Margin of Safety

Gilead’s valuation remains compelling with a 10% EV Free Cash Flow yield, 4x EV to Sales (2018) and 11x Price to Earnings (2018) multiple. We estimate that the HIV franchise alone is worth just over ~$65 per share, the HCV franchise ~$10 per share (accounting for substantial run-off) and the probability adjusted pipeline including CAR-T, NASH, rheumatoid arthritis and Crohn’s disease therapies at ~$20 per share – all up ~$95 per share, against a current share price of $75.

Unlike biotech peers such as Celgene and Regeneron, Gilead is not subject to relatively large binary risk and will be repatriating around $30bn in cash from overseas with optionality for dividends, buybacks or future acquisitions.