Updated 13 March 2020

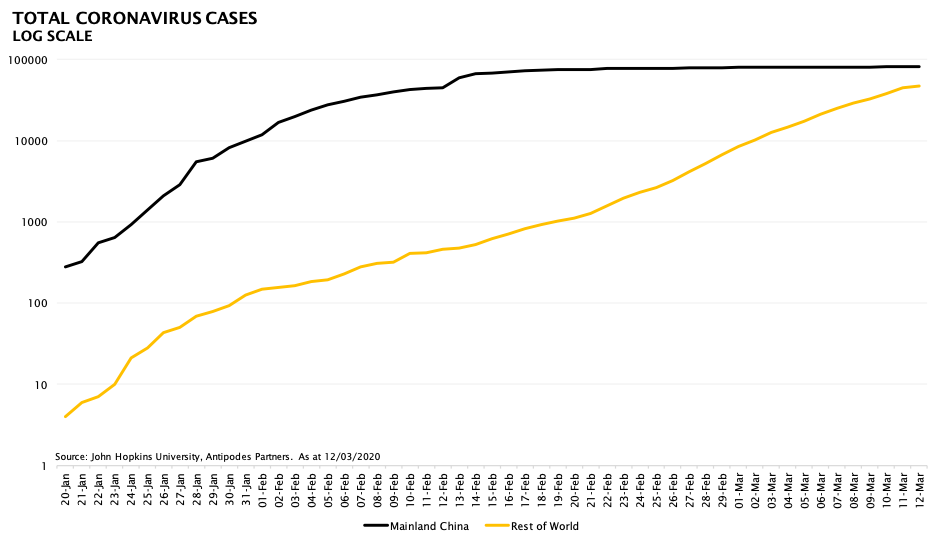

Coronavirus (COVID-19) is playing out in real-time. The key issue for markets is that the infection rate outside of China is accelerating, exposing an underlying fragility in markets.

Within China, the number of confirmed cases appears to be stabilising and our high frequency indicators suggest economic activity is slowly beginning to normalise.

Focus has shifted from the Asian epicentre, to that of a global pandemic, with implications for global economic activity (currently reflected in the ongoing decline in global bond yields).

Learnings from the outbreak so far

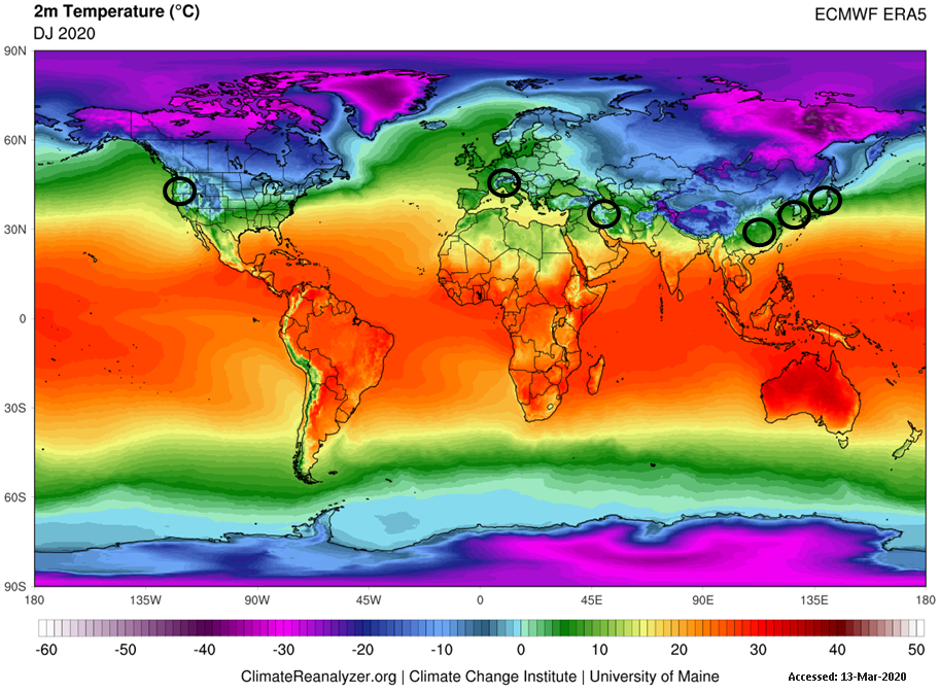

Now officially declared a pandemic by the World Health Organisation (WHO), the SARS-CoV-19 virus remains difficult to contain, with evidence to date suggesting infected individuals without symptoms may be able to transmit the virus. The active northern hemisphere flu season may be camouflaging the spread given most individuals infected have symptoms consistent with a mild seasonal flu, compounded further by limited testing being conducted in most countries.

While still early days the global spread of the virus, and the larger outbreaks outside of China, appear concentrated in areas that experienced colder weather in January and February namely Europe (see image below). With largely open borders (until this week), Europe has a far more onerous task of containing the spread. At this early stage there appears to be limited evidence of large and sustained transmissions/outbreaks in more tropical latitudes and in the southern hemisphere. Overall, the data to date suggests cold climates may be facilitating viral transmission and the coming summer season in the Northern Hemisphere may provide relief.

Observations from a select few outbreaks ex-China have also provided some clues to the virus’ transmission characteristics, and insights into potential upper/lower bounds of case fatality ratios.

The outbreak on cruise ship “Diamond Princess” was one of the more insightful as it more closely reflects a controlled experimental environment for transmission. Passengers and crew were forced to remain onboard during the ordeal. Of the 3,711 crew and passengers onboard, 696 were positive for SARS-CoV-19 representing an infection rate of 18.8%. Sadly, the 6 deaths reported so far implies a fatality rate of 0.86%, far below other outbreak areas like Wuhan (China) at 4.5%. The key points are the high infection rate due to a very close-quartered environment, which may be extrapolated to estimate the upper end of the attack rate for an unconfined population, while the lower fatality rate could potentially serve as a reference for a broader population yet to be exposed.

South Korea provided insight into what the underlying infection rate is in a larger population exposed to the virus. Data obtained earlier this week showed South Korea had tested more than 210,000 individuals in a short period and identified 7,755 infected cases, translating to a positive rate of 3.7%. Based on this data the case fatality rate in South Korea was ~0.7%, also lower than mainland China.

Finally, we turn to Italy, which is experiencing one of the more severe outbreaks, particularly in the Northern state of Lombardy (Milan). The data is sobering, with one of the highest fatality rates at ~28%. The demographics seem to be a factor with 60% of the population aged 40 years and over versus the US which is closer to 48%. As reviewed in our last note, this age group is more at risk of succumbing to the disease. Population density is high in this region of Italy and it is likely the combination of these factors and a lack of being prepared led to the more severe outbreak.

From here the market will be sharply focussed on spread of the virus in Europe and the US. While warmer weather on the horizon for the US may provide some relief, at this point it remains too early to call. Results flowing from the recent ramp up in testing will be closely followed over the coming weeks and will provide a clearer picture.

Impact on markets

The immediate response by markets, as it has evolved from the Asian epicentre to a global pandemic, has been to reduce economically sensitive exposures, originally to Asia and now globally.

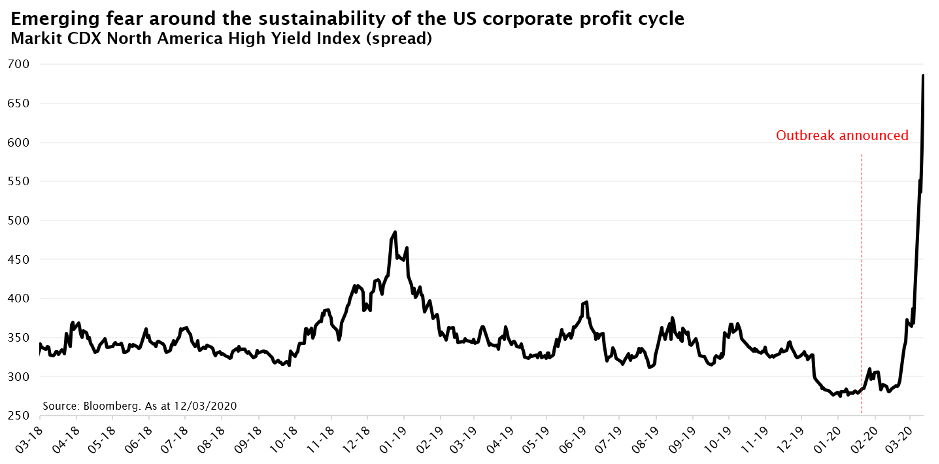

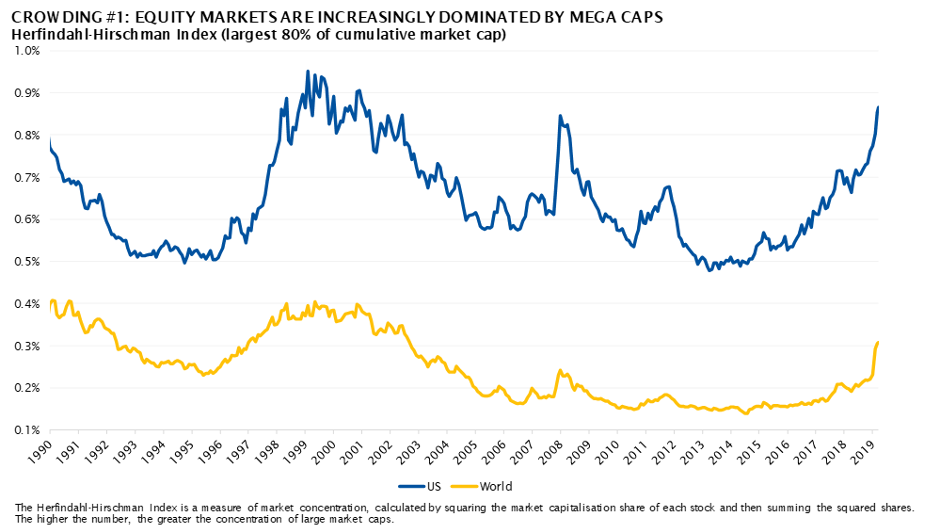

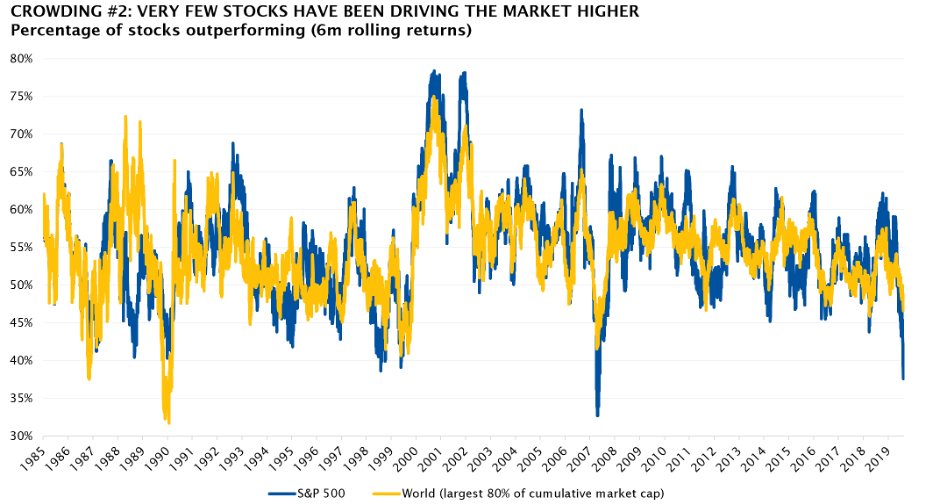

We’ve also witnessed a broader de-risking of equities, including beneficiaries of the duration bubble (a key point of fragility for equity markets given extreme crowding in these types of exposures, and particularly within the US where they dominate). We also note the widening of credit spreads, as fears around the sustainability of the corporate profit cycle re-surface.

The dislocations in markets have accelerated into March as recessionary fears have taken hold, only to be compounded by a disintegration of the OPEC+ alliance, sending oil to a low of $31.

Longer term implications

It will be difficult for Western governments to contain the virus in the same manner China has with an aggressive lock down on the movement of people. Hence, the headlines regarding Western spread will remain negative and the stock market may continue to react to this.

Accordingly, China’s apparent containment will not necessarily represent a playbook for the West. Chinese stimulus efforts, both monetary and fiscal, likely lead to a rebound in economic activity as China slowly goes back to work. The question for China is whether infection rates spike again as this happens. Elsewhere, testing volumes remain low in comparison to China, Korea and Italy and investors should continue to expect a rise in infection rates outside of China as testing volumes increase.

The Western playbook may eventually iterate to less about containment and more about treatment. However, initial containment efforts will clearly slow the economy and if prolonged, we’d expect equity markets to remain volatile as uncertainty around corporate earnings gets priced in.

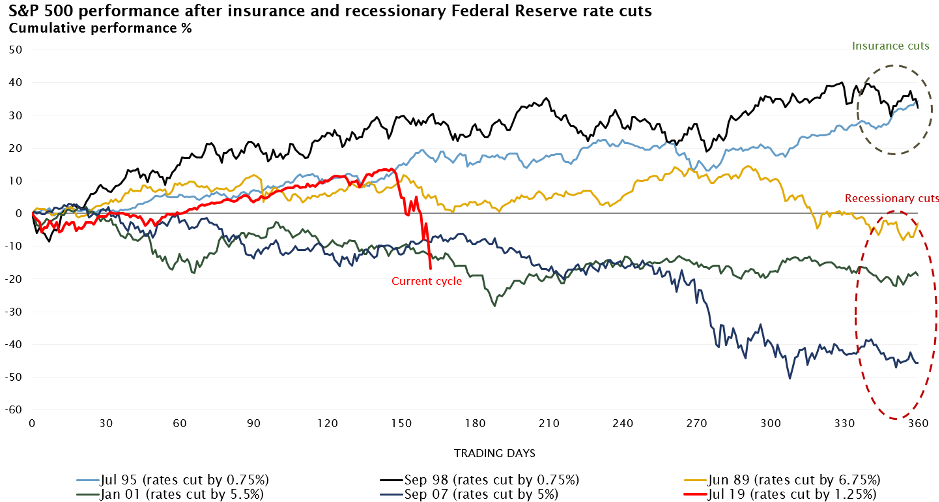

As we commented in the December Quarterly Report, prior to the Federal Reserve’s most recent 0.5% policy rate cut, buoyant equity and credit markets had interpreted the Fed’s actions as mid-cycle insurance cuts. In stark contrast, the fixed income market continues to price in a much lower growth/later cycle/recessionary environment with very little change in record low real yields across the curve. A study of previous Fed easing cycles highlights two distinct types – insurance (shallow cuts) and recessionary (deep cuts). Unsurprisingly, equities do well under the former and poorly under the latter.

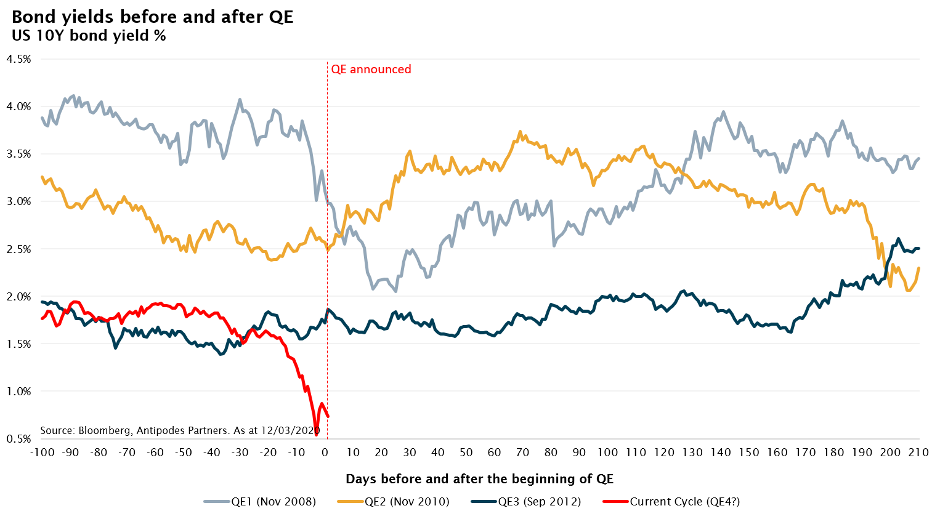

How the apparent inconsistency between equity and bond markets is resolved has broad implications for both equity sector and style outcomes. From a credit perspective, there has been both a supply chain shock (factories in China have shut) and a global demand shock (social distancing, impact on travel, retail, etc.). The ensuing funding crunch as payments are missed and credit lines are drawn requires more than just rate cuts. It needs fiscal stimulus and QE (banking reserves need to be replenished).

Increasingly, as interest rates approach zero there will be a need to accompany monetary policy with fiscal stimulus. This could come in many forms. In Europe and China, green stimulus (e.g. EVs, energy efficient buildings/appliances), in China specifically, the acceleration of 5G rollout (e.g. encourage phone upgrades), while in the US this may mean more tax cuts. The US housing market is sensitive to low rates, and the collapse in the yield curve has led to a spike in refinancing. Further, pent up demand for US housing is high (the average age of the US housing stock is 30 years, last seen in the 1940s) as the cycle has taken time to recover post the GFC. This could act as a counter-balance to any consumer slowdown.

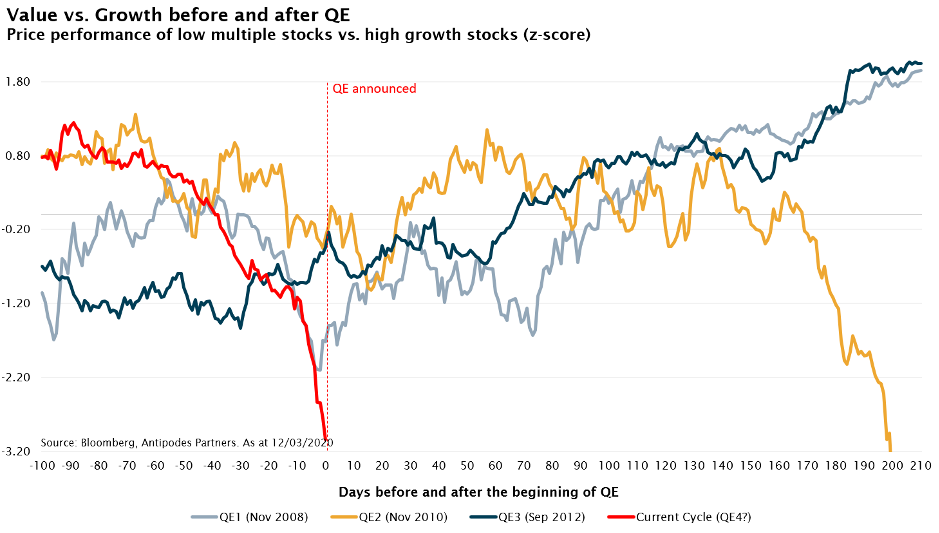

The derating in the economically sensitive parts of the market has been immediate and severe. The question facing investors now in terms of their equity exposure and asset allocation is how will bonds react to stimulus? If bond yields rise, the potential carnage in long duration equity beneficiaries would be very painful.

Previous episodes of QE have seen investors recalibrate their expectations around economic growth higher, followed by a subsequent re-rating in yields and the outperformance of low multiple – or so called “value” – stocks. This is not a given considering a degree of policy fatigue exhibited by markets, but underscores all the more a need for a powerful QE and fiscal policy response. The proposed schedule of overnight and term repurchase agreements announced by the New York Federal Reserve on the 12th of March sounds large at over $1 trillion, but offers little in terms of sustainable reserves given their short maturities. The Fed will be required to offer liquidity at longer durations to build confidence with the market. The sustainability of any “value” rally will likely depend on the quantum of stimulus afforded to markets and the degree to which this eventually feeds back into economic activity.

It will pay to keep a close eye on the performance of corporate credit in divining the answer to the mid versus late cycle conundrum. The initial reaction from credit markets is indicative of a swing back towards a recessionary outcome with US high yield credit default swaps widening ~400bps since the onset of outbreak, i.e. the probability of a more severe default cycle has increased. It will also pay to keep any eye on the Democratic Party presidential candidate selection process. If recessions risks rise, a market friendly Trump win in November will no longer represent a slam dunk.

Portfolio positioning

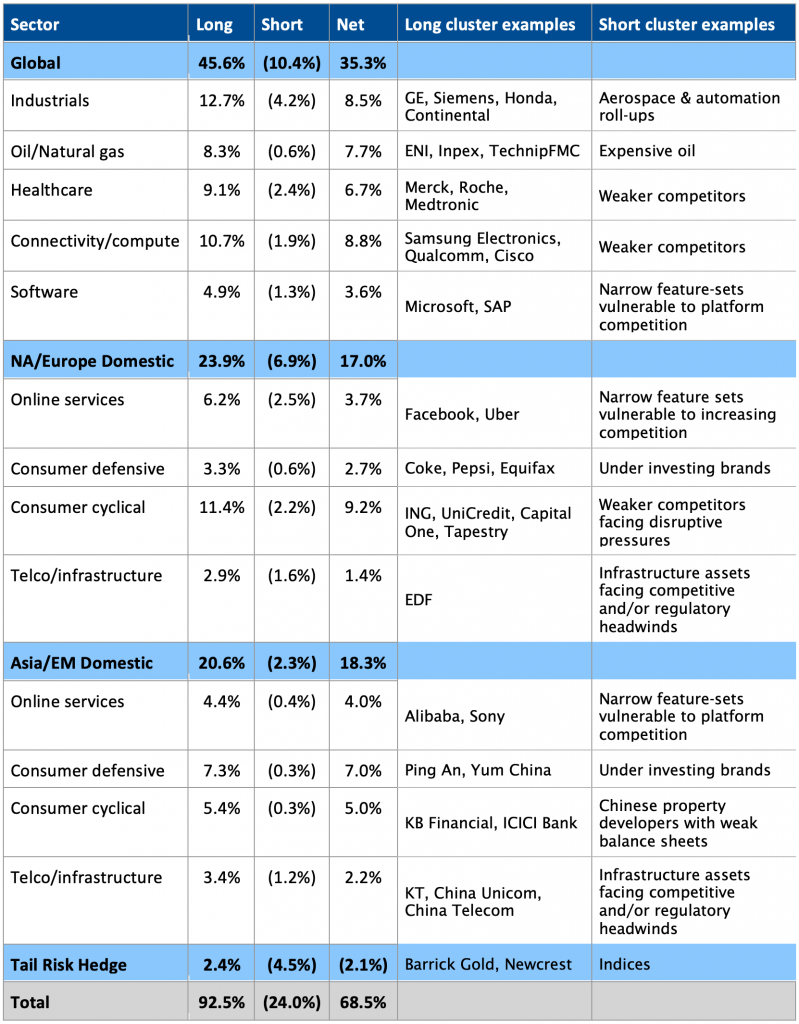

The current backdrop could be characterised as an extended global economic cycle, relative weakness in profitability/balance sheets outside of the large technology platform companies and a general lack of margin of safety amongst domestic facing US equities. Against this opportunity set, the Antipodes Global Fund and the Antipodes Global Fund – Long are positioned as follows:

- Low net exposure to equities (Antipodes Global Fund), with low exposure to economically sensitive US domestic exposed equities and low exposure to the more economically sensitive versions of the expensive defensives such as weaker consumer staple brands and restaurants

- A preference for consumer retail/services with a high exposure to online, as opposed to traditional foot traffic

- Defensive healthcare positions with limited exposure to discretionary spending behaviour and potential upside around coronavirus vaccines and therapies:

- Gilead, with its experimental drug Remdesivir, an antiviral drug, has shown impressive activity against coronavirus in lab studies and in one human case. If clinical trials are successful, it may be used to treat already infected individuals that are particularly vulnerable to the virus (i.e. the elderly)

- Merck and Sanofi, as global leaders in vaccines, could benefit if successful in developing a COVID-19 vaccine

- Exposures to high quality globally orientated businesses with a high margin of safety, structural growth prospects and better positioned to withstand regional macroeconomic disruption

- Targeted tail risk exposures such as gold and credit event protection (Antipodes Global Fund). With issuance of junk credit having tripled as a share of GDP across the US and Eurozone since 2008, against a backdrop of elevated leverage ratios and credit spreads nearing post GFC lows, corporate credit will be vulnerable to a coronavirus slowdown in corporate profit growth.

- Shorts, balanced around offsets to our long cyclical exposures and beneficiaries of the duration bubble (Antipodes Global Fund)

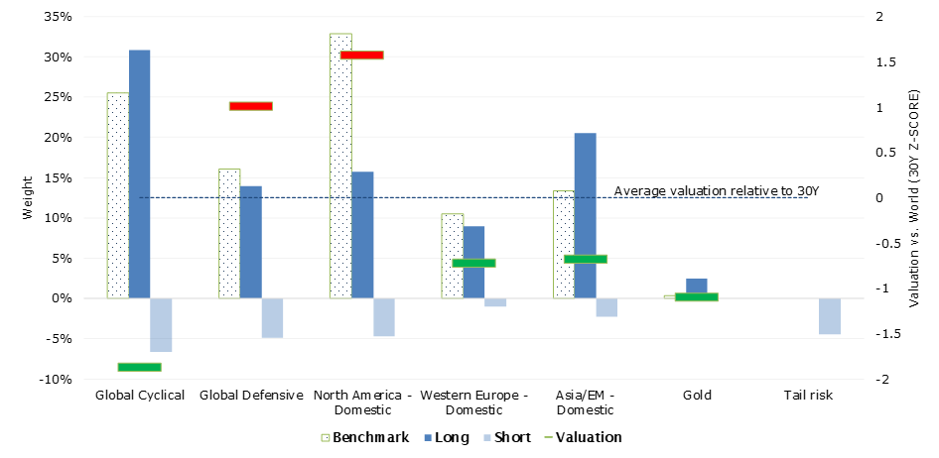

Global Long-Short portfolio positioning vs. benchmark and valuation

Over the course of the outbreak, Antipodes has selectively increased defensiveness and continued to invest in targeted tail risk protection (in the Antipodes Global Fund this includes credit protection). We will remain tactical around these exposures as policy response starts to accelerate.

Amidst the market turmoil in February and March (to the 12th), the MSCI All Country World Index (net) returned -18% while the Antipodes Global Fund (-9.9%) and Antipodes Global Fund – Long (-15.7%) both outperformed.

Global Long-Short portfolio clusters

As at 31st December 2019. As of February 2020 net exposure was reduced to 56%.