Since our inception in 2015, we’ve secured the loyalty of large and sophisticated clients as well as financial advisors and individual investors.

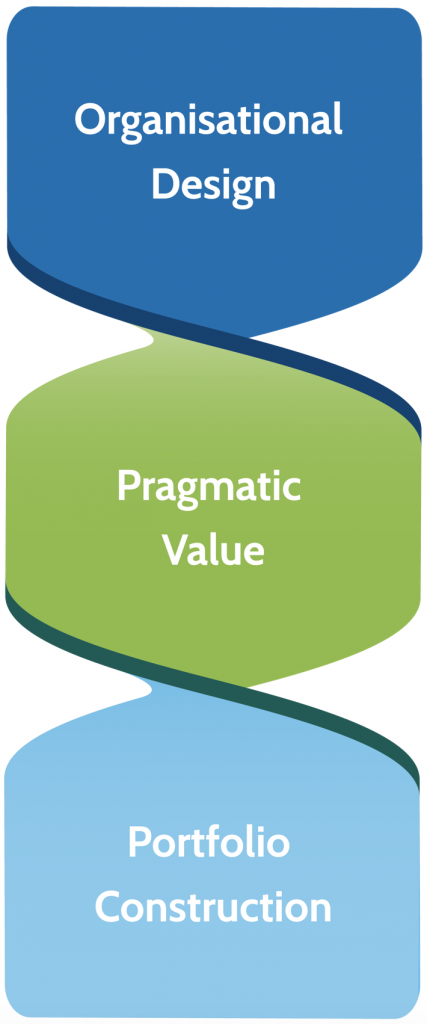

We’ve been the recipient of prestigious industry awards and accolades. We believe our success is best attributed to the experience of our team, the methods they employ and the values that drive our organisation.We believe that the combination of three core factors differentiates Antipodes from our peers and explains both our competitive advantage and our outperformance of the markets. They are Organisational Design, Pragmatic Value and Portfolio Construction.

Organisational design

We have built a team of seasoned investment professionals whose skills and experience are augmented by the enthusiasm of the youthful talent we have attracted to the firm.

Our commitment and alignment are assured by the fact that we are majority owners of our business and significant investors in our own funds.

With Pinnacle Investment Management handling our infrastructure and marketing, we’ve been free to create a culture that is focused purely on investment success where we can concentrate on undertaking fewer tasks but executing them more effectively. We are global investors with specialist expertise in emerging markets that gives us a distinct advantage over our European or North American counterparts and has enabled us to profit from resilient companies listed in emerging regions.

We are passionate about teamwork and operate in a highly transparent environment. To maintain the right balance between personal motivation and collaboration, our compensation is based on an individual’s contribution to their sector team as well as to the final portfolio. This encourages all members of the team to think like portfolio managers and rank opportunities relative to other ideas and existing opportunities.

This philosophy creates an efficiency that makes it easier to assemble and build the portfolio and also to coach, mentor and direct the budding talent within the team.

Pragmatic value

We describe our investment philosophy as ‘pragmatic value’. It’s been carefully designed to avoid the pitfalls of more traditional value investing that can lead to investing in value traps or an over-reliance on ‘mean reversion’ – the notion that asset prices will eventually return to average historical levels.

While adopting a fundamental approach, we’re always mindful of context. We assess every opportunity holistically and study the cyclical, structural and socio macroeconomic forces that will shape the environment of potential investments.

Our integration of quantitative tools within a fundamental framework gives our analysts a process that enables deep stock level research while maintaining a helicopter view of what is happening in the surrounding market. This combination of depth and breadth reveals opportunities and risks that might otherwise be overlooked.

Ultimately, this leads to a better-balanced portfolio, one that can deliver in both the short and the long term and rides the storms in what we like to call an ‘all weather’ approach.

Portfolio construction

Portfolio construction is at the very heart of our process.

As high conviction investors we are looking to assemble portfolios of attractively valued, quality stocks that can be left to perform well over the medium to long term. But, at the same time, we remain constantly mindful of risk and are vigilant in protecting our investors’ capital.

We achieve these twin objectives through a process of ‘clustering’.

We group stocks that display similar characteristics together and then build portfolio, with a number of these clusters.

This ensures two outcomes.

It concentrates our research into a limited number of areas where we can then dive deeper to find insights and opportunity.

And it creates a level of diversification within the portfolio to help protect us from unexpected volatility or down drafts in the market.

We believe that the fusion of organisational design, pragmatic value and portfolio construction creates the synergy that has enabled Antipodes to deliver favourable client outcomes. But we’re not resting on these laurels. We are committed to exploring all opportunities that will improve our performance – new quantitative tools, new data sources, new communication tools. Whatever it takes to stay ahead of the curve.

We specialise in investing in shares on a global basis. That is our expertise and sole area of focus. It’s also, we believe, the greatest area of opportunity for an investor.

Typically, our clients are looking for long-term growth from an investment in global or Asian shares. While there are many approaches or ‘styles’ in investing, Antipodes appeals to investors who are seeking a high-conviction, value-oriented approach. With offices in both Sydney and London, we have a unique perspective on the trends impacting industries and companies which results in differentiated portfolios.

In Australia, our clients are often looking to diversify away from an overexposure to local companies and instead invest in industries that are not represented in the local market.

You can find all the application forms and procedures for our managed, listed, PIE and offshore funds here.

Read more >We act for the benefit of our investors while actively contributing to the development of a stable, sustainable and inclusive global economy.

Read more >Our fundamental, pragmatic value-focussed approach focusses on buying great but undervalued and building a concentrated portfolio.

Read more >