Mobile connectivity positions such as Qualcomm currently comprise ~5% of the Antipodes Global Fund, with our position in the latter building steadily since mid-2017.

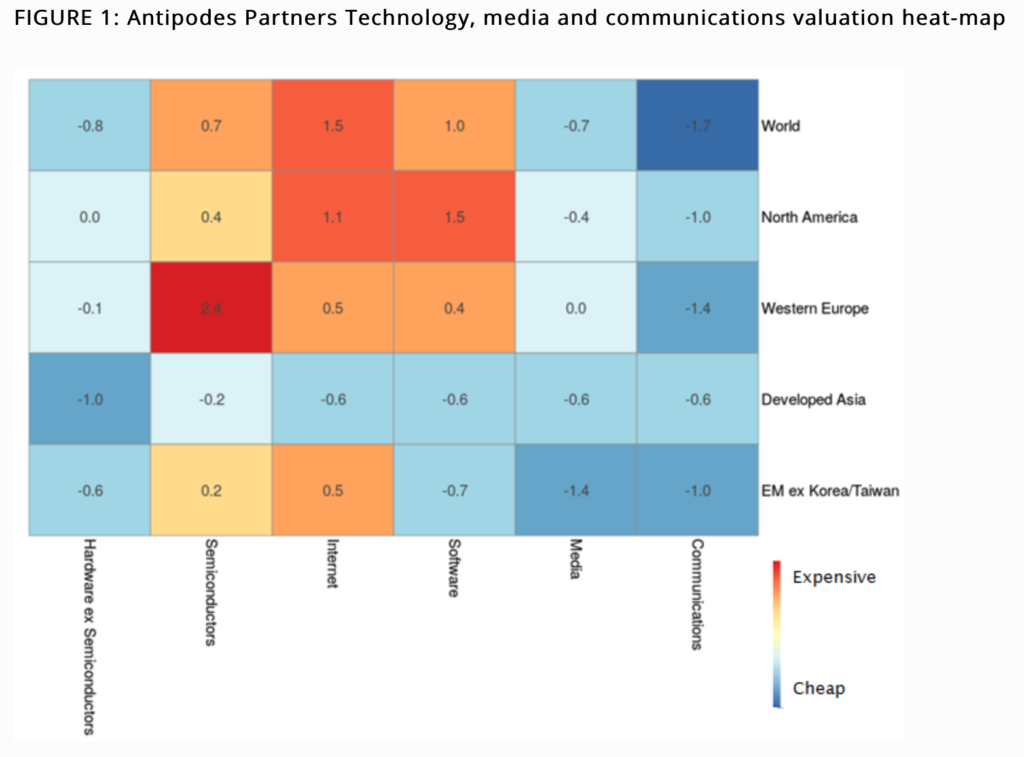

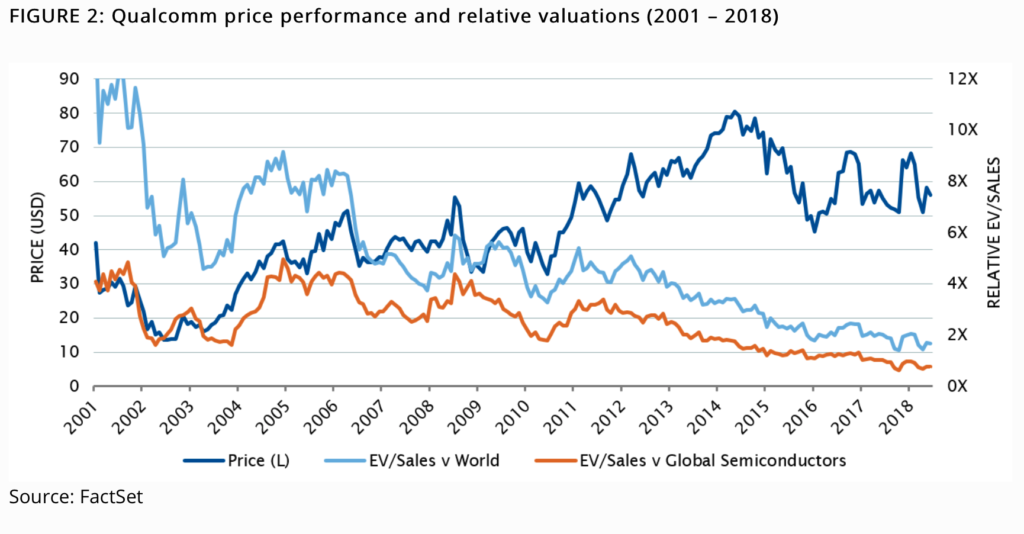

These exposures are cheap relative to rapidly expanding addressable markets as the confluence of low latency 5G and accelerated computing technologies facilitates autonomous driving, IoT and immersive device-led VR applications. Figure 1 details how aggressively North American Semiconductor, Software and Internet stocks have been rerated and Figure 2 how starkly Qualcomm has been left behind.

The above heat-map provides an illustration of valuation clustering across technology related sectors and regions. Cell colouring indicates the degree to which a sector’s Enterprise Value (EV) to Sales multiple relative to the world is above or below its 33-year trend (expressed as a Z-Score, the number of standard deviations above or below the average). The warmer the colour, the greater the relative multiple versus history; vice versa for the cooler blues, with extremes highlighted by the boldest of colours.

Irrational extrapolation

More than 2 billion people rely on Qualcomm’s technology to make and receive phone calls, consume digital services and conduct commerce over mobile devices. Qualcomm invented many of the technologies that are at the heart of the communications revolution of the past 25 years and remains dominant in the supply of intellectual property (IP) and chips that allow mobile communication systems to function. However, more broadly, the company is a leading designer of low power, high performance chipsets and is well positioned to broaden its dominance in mobile into server and automotive applications.

Yet these virtues have been clouded in recent years by a series of controversies surrounding its Licensing business and relatively mediocre profitability from the Technologies or mobile chipset business. The result is a stock which has significantly underperformed semiconductor peers and now trades at a single digit multiple of long-term earnings power.

Qualcomm operates as two business, Licensing and Technologies, with Licensing providing approximately 75% of operating profits historically ($6.5 billion of $8.1 billion in 2016). The licensing business generates revenue by charging mobile device manufacturers such as Samsung and Apple for the use of Qualcomm’s intellectual property (IP). This is typically a stable, high-margin business that has grown, and should continue to grow, with the number of devices that are shipped globally each year. In mid-2017 however, Qualcomm and Apple’s relationship soured to the point where Apple withheld licensing/royalty payments whilst they argued that Qualcomm’s terms for payment were unfair. Analysts have lowered their Qualcomm’s 2018 profit estimates to ~$5.0 billion to reflect an estimated $3.2 billion in lost Apple licensing revenue, largely pure profit, and $500 million in additional legal costs incurred in defence of its IP position.

Multiple ways of winning

Apple’s decision has led some to believe there will be a fundamental reset to the way in which IP is monetised across the industry – overturning 25 years of industry practice and creating uncertainty to the outlook. However, whilst one may have expected all other handset vendors to take this as an opportunity to also cease paying Qualcomm its dues, this has largely not occurred and critical new deals, certifying the ongoing legal legitimacy of the patents, have since been signed with many key vendors, including government agencies such as China’s NDRC, representing over 100 Chinese device makers, and customers such as Samsung Electronics who refreshed their deal in January 2018. Hence whilst we don’t have specific insights into how a court might ultimately adjudicate, we would be surprised if any court could determine that Apple should somehow be treated differently from others in the industry and that broader patent protection, which is unambiguously something that benefits American companies, no longer applies for innovators. Ultimately a court decision is highly improbable and a commercial agreement is likely to be reached which would restart the Apple royalty stream, including a onetime payment for royalties withheld since mid-2017. Whilst unlikely, the worst case entails Qualcomm accepting a 25%-40% reduction in payments, what we understand Apple is arguing for, which would perhaps then trickle to other licensees and impair license profits by up to 50%. Apple continue to ship millions of devices each quarter which rely heavily on Qualcomm IP and, ahead of important developments in 5G over the next 2 years, we believe Apple will want certainty around their own business model.

Qualcomm’s Technologies business supplies chips that power mobile devices – the modems and application processors that are the brains of the modern-day cell phone. This segment has been historically undermanaged, with margins significantly below what we believe are achievable given Qualcomm’s scale. Essentially, this amounts to taking a much harder line on product range and cost, while noting that semiconductor peers with similar dominance routinely generate operating margins well above 20% versus Qualcomm’s more recent levels in the mid-teens. This can be an important lever to drive value for shareholders over the next few years.

In addition, Qualcomm should take control of the world’s leading supplier of semiconductors to the automotive market (NXP Semiconductor) later this year, where we see tremendous synergies with its existing prowess in communications meeting the demand of the next generation of connected vehicles – an exciting combination which fits with several other Antipodes holdings in our Mobile Connectivity cluster.

In summary, we see multiple ways to win over the next 3 years including a) settlement of outstanding disputes with Apple, b) a much sharper focus on margins within the Technologies business, c) successful integration of NXP, and d) the initial ramp of 5G technologies where Qualcomm should naturally lead.

Margin of safety

Qualcomm has de-rated relative to both the World and its Semiconductor industry benchmarks (Figure 2). As the uncertainties that have weighed on the stock are resolved, the market is likely to recognise Qualcomm’s earnings power and potentially a share price of over $90/share. Further, naturally high profitability allows the company to sustain a generous pay-out ratio and an attractive ~5% dividend yield whilst we wait for our investment case to play out.

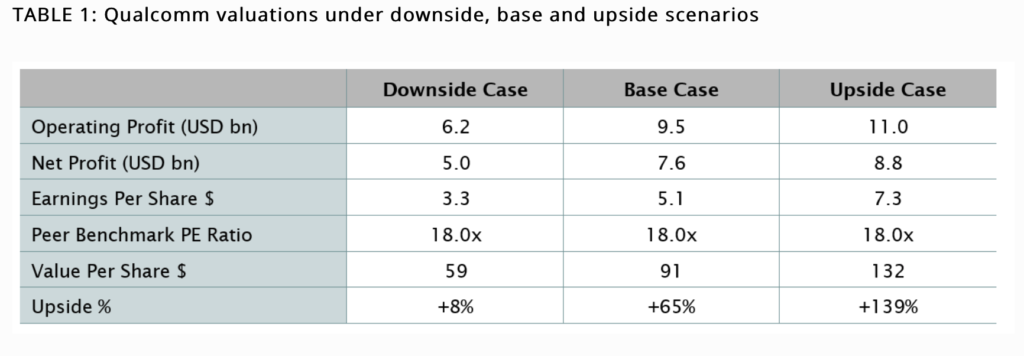

At the current share price of $55, Qualcomm has an enterprise value of $65 billion. In looking at potential outcomes we’ll consider 3 scenarios: firstly, the downside/doomsday scenario of the Apple negotiation permanently wiping out 50% of licensing profits with Technologies profit remaining flat; secondly, the base case of the existing royalty framework maintained with Apple and Technologies profit remaining flat and; thirdly, the upside case of also successfully closing the NXP acquisition or applying the $17 billion of surplus cash to buy back 20% of issued shares whilst also growing Technologies margin to 25%, from 17% currently. Applying a peer benchmark PE ratio of 18x[1] leads us to the conclusion that the asymmetrical nature of the risk-reward payoff is highly favourable.

Further evidence of Qualcomm’s portfolio and industry position were provided last year when rival semiconductor company Broadcom unsuccessfully bid for the company. Only an 11th hour US foreign investment review prevented the transaction from completing, but an industry insider was prepared to pay upwards of $80/share, despite current uncertainties, versus recent prices in the mid $50’s. Meanwhile, for what it’s worth, Qualcomm’s ex-Board Chairman and CEO has actively sought financing for a take-private bid for the company.