Except for a select few, major pharmaceutical shares have performed poorly over the last few years thanks to negative real interest rates (favouring duration), heightened risk of US drug pricing reforms, intensifying competition and many companies facing large patent cliffs over the next decade. Pharmaceutical valuation multiples compressed materially relative to major world indices and currently sit at close to 10-year lows.

In spite of these industry issues, Sanofi (EPA: SAN) is well positioned with its shares trading at a near historic discount to peers despite it becoming increasingly clear that new management is executing well on a long-needed transformation. Margins are improving, the business is more focused, less complex, retains a strong balance sheet and the new management team has multiple options to create value for shareholders – the most important of which is reinvigorating the drug pipeline. Relative to other pharmaceutical companies, Sanofi is one of the more diversified, with a leading global consumer health business; a defensive vaccines business with high barriers to entry; and the rare diseases unit (Genzyme), which should be more durable longer-term. Over the next decade Sanofi’s ‘patent cliff’ outlook is one of the most attractive versus peers. With key new appointments since late 2018 including CEO, CFO and Head of R&D holding a clear mandate for change, we see multiple ways of winning in owning Sanofi shares at current levels.

Irrational extrapolation

Investor concern has primarily centred around the company’s heavy exposure to diabetes drugs (~26% of its pharmaceuticals sales in 2014), particularly its exposure to insulins, which face material pricing pressure and competition in the US market. This exposure drove years of earnings disappointments and downgrades which, coupled with a lack of meaningful pipeline candidates to offset and Sanofi’s relatively poor R&D track record versus peers, exacerbated investor disdain.

Sanofi also suffered from Board and Management reluctance to address the burgeoning cost base and simplify the business. Sanofi’s profit margins were well below peers and declining while peer margins expanded. Combined with a history of poor capital allocation decisions (e.g. acquiring Bioverativ in 2018) and more recently the threat posed by mRNA disruptors to its flu vaccines business (~7% of sales in 2021), Sanofi became a classic ‘value trap’.

Sanofi shares currently trade at a ~25% discount to peers on a relative PE basis, below its average 20% discount over the last 15 years. The market is clearly extrapolating Sanofi’s historical woes into the future. The historic headwinds around diabetes have now largely played out. Insulins are now a much smaller part of the business, following Sanofi’s astute 2019 decision to terminate pipeline development and cut commercial costs in both diabetes and cardiovascular drugs. This move has unlocked significant cashflows for reinvestment into more attractive areas like Oncology, Immunology & Inflammation, Neurology and Vaccines. The threat posed by mRNA technologies to Sanofi’s leading seasonal flu vaccine business is overstated by the market. Recent data announced by Moderna highlights the very high hurdles (particularly in terms of safety/tolerability and efficacy) that still exist for these novel approaches. In our view the established flu vaccine oligopoly remains defendable and Sanofi is not standing still, announcing plans for a mRNA Centre of Excellence and annual investment of €400m. It has successfully made progress in optimising its mRNA vaccine technology for longer shelf-life, easier transportation, lower reactogenicity and the switch to modified mRNA backbones. Sanofi has leading global manufacturing scale and is aiming to have six mRNA vaccines in clinical trials by 2025, including next generation flu vaccine candidates.

Business resilience/Multiple ways of winning

Competitive dynamics & product cycle

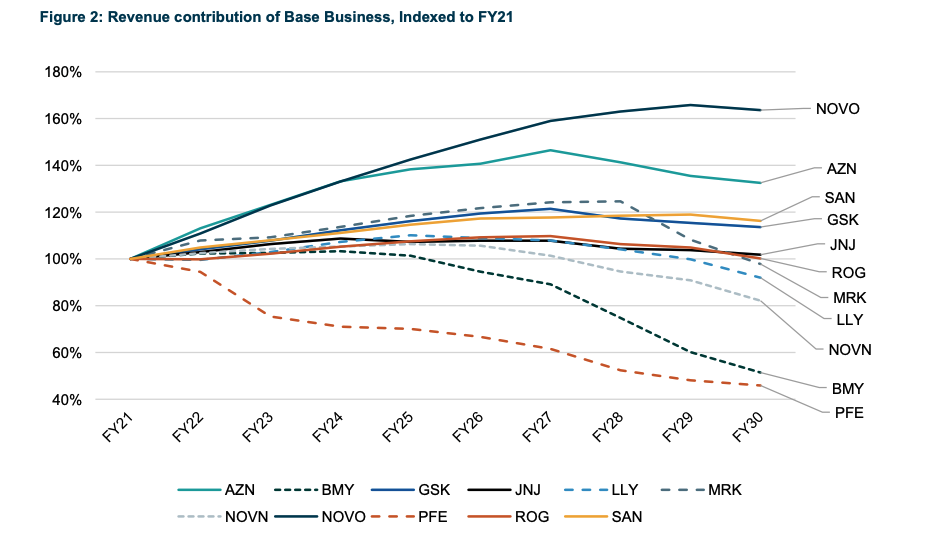

Sanofi has a strong base of existing products with limited patent cliff exposure until the end of the decade. A key driver of its growth is Dupixent, which currently has annualised sales in excess of >€5bn. Competitive threats to Dupixent have largely faded. Given the expanding list of approved indications, we expect Dupixent’s peak sales target could be lifted to >€13bn. Patent protection has the potential to extend beyond 2030 which would provide a further long-term value driver. Sales and earnings growth visibility for the Sanofi’s base business is high and currently growth sits above peer average until 2030 (chart below). With this setup, it will not take much from the pipeline to meaningfully increase the outlook for Sanofi sales and earnings through to the end of the decade.

The pipeline is being shrewdly rationalised, freeing up resources to allocate to the most prospective programmes and/or business development activities with a focus on attractive areas like Oncology, Immunology & Inflammation, Neurology and Vaccines. Over 30 R&D projects were discontinued between 2018 and 2020 which included handing back gene therapy rights to Oxford Biomedica and more recently returning gene editing rights in sickle-cell disease to Sangamo. The slower growing General Medicines business (~40% of group sales in 2021) is also being rationalized with the aim to cut non-core product families by 65% through 2025, delivering €1.5bn in free cash flow savings. Further simplifying the business, Sanofi also executed a timely sale of its stake in Regeneron, raising ~US$11.7bn.

This refocusing of resources has all allowed the company to acquire and/or develop several ‘platform technologies’, each with the potential to generate multiple new drugs over the next decade, including mRNA (therapeutics and vaccines), NANOBODY drug technology, allogeneic Natural Killer cell (NK cell) therapies, multi-specific antibodies and Tailored Covalency (Bruton’s Tyrosine Kinase (BTK) inhibitor drugs) to name a few. We are supportive of this approach while acknowledging that it can take time for the innovation engine to turn around. Delivering on the pipeline will be a critical driver for any valuation re-rating. The most important near-term clinical trial read-out is the pivotal AMEERA-3 trial of Sanofi’s oral drug, Amcenestrant, in metastatic breast cancer. Results are due in the first quarter of 2022 and, despite market scepticism around efficacy, we are more confident it will succeed and unlock a potential multi-billion-dollar market. While the success (or failure) of this drug in the coming few months will be a key moment for rebuilding market confidence in Sanofi’s R&D turnaround, the company’s prospects do not solely hinge on this drug. Sanofi has candidates in various stages of development with differing mechanisms of action and differing targets, all of which have modest expectations in market models. Sanofi COVID-19 vaccine sales also provide upside to group sales from 2022 where current expectations are for <€300m contribution. Overall, Sanofi is a highly diversified business with limited patent cliff risk and its Consumer Healthcare, Vaccines and Specialty/Rare diseases provide durability.

Regulatory

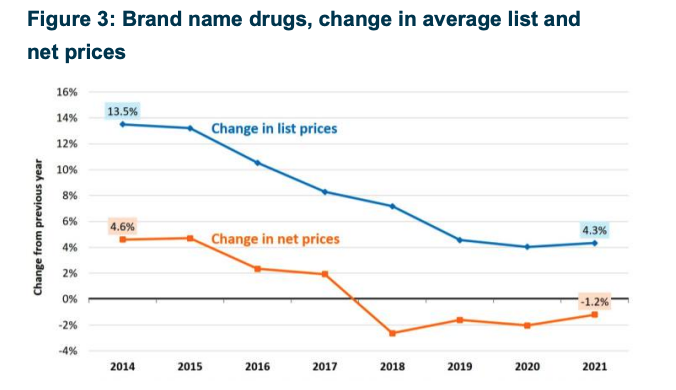

The risk of major US drug pricing reforms has perhaps been the most prominent impact on all pharmaceutical companies. While Sanofi has one of the lowest exposures to US drug pricing reform risk relative to peers, this has nonetheless been an overhang for the shares. After much rhetoric from the Trump administration on its plans to slash drug prices, ultimately little changed. What did occur was ‘self-policing’ by industry participants, with most major drug companies significantly limiting the yearly ‘list price’ increases, which resulted in an aggregate decline in the ‘net prices’ realised by drug companies (i.e. reported revenues). This dynamic appears to have alleviated some of the pressure from the US Government to enact major change and shifted policymaker focus to the actions of intermediaries or ‘middlemen’ (e.g. Pharmacy Benefit Managers or PBMs), and the roles these businesses play in inflating drug costs.

With Democrats winning the US 2020 election the risk of major drug price reforms perhaps peaked. However, with only the slimmest majority in the Senate, and multiple failed attempts at introducing legislation, it’s becoming clear that Democrats will have little chance of successfully passing new drug pricing legislation or regulations that materially impact the drug sector, and current proposals are a relative win for the industry (compared to what could have been). We consider the chances of major reform in the medium term to be very low, thus removing a major multi-year regulatory overhang for the major pharmaceutical companies.

Management and Financial

Outside of the pharmaceutical pipeline, Sanofi has multiple options to unlock value. The announced spin out of the euroAPI business, while a potentially relatively small win, highlights management’s clear focus on reducing complexity in the business and unlocking value. Perhaps the largest source of latent value is the Consumer Healthcare (CH) business, a collection of household overthe-counter brands including Telfast, Betadine and Bisolvon.

The global CH industry remains a relatively fragmented subcomponent of the FMCG landscape and is ripe for consolidation. Sanofi, as one of the largest players, will have a critical role to play in this. While management communication supports its retention, the classic hallmarks of preparing for a sale have been in place for the last few years. Sanofi expects the CH business to be operating as a standalone unit by the end of 2022, and it has been separately reporting the segment for some time. CH businesses trade on significant premiums to pharmaceutical companies due to lower patent risk and hence a longer duration cash-flow profile. However, we think this premium is not being recognized within Sanofi’s overall market value.

Based on current global consumer business multiples, and precedent deals in the sector, we estimate a sale of Sanofi’s CH business could unlock up to €30bn in value, providing Sanofi €50bn+ in debt headroom to rebuild its pipeline and/or deploy to capital management initiatives.

Overall, we expect business development activity to continue at an elevated pace and the recent correction in biotech share prices means target company valuations are becoming more reasonable.

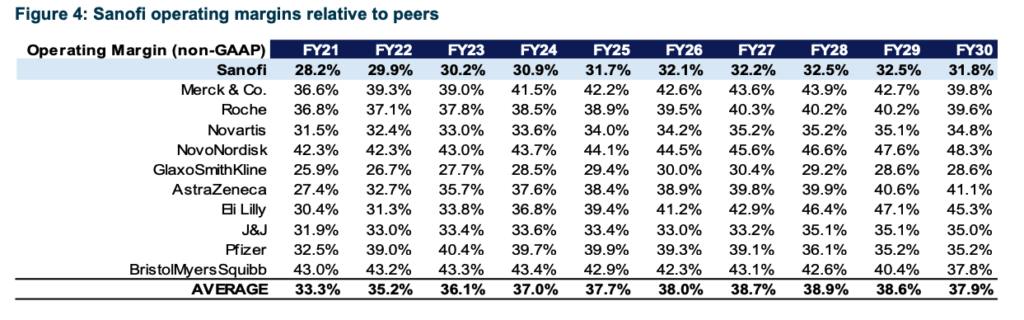

Finally, management has targeted business operating margin to increase from 30% in 2022 to >32% in 2025. We think these targets could be exceeded given the improvements seen to date and additional benefits to come from improved sales leverage and optimisation of Dupixent manufacturing. The market is expecting very little margin expansion beyond the 2025 target (table below). We think this is too conservative: Sanofi should significantly narrow the margin gap relative to peers, especially if the CH business is sold.

Style and Macro

Sanofi is well-positioned to benefit from any market rotation into more defensive equities and as we progress into a ‘late cycle’ or rising rate narrative. The aging demographic is a long-term tailwind to drug utilisation and as improvements in biotechnology methods and applications continue to accelerate at a blinding pace, we expect pharmaceutical companies to benefit from increasing R&D productivity relative to history.

Margin of error

Sanofi shares are cheap, trading at only 11.7x our estimated 2022 earnings per share (EPS) for a business potentially growing EPS in the low double digits over the medium term. While we see asymmetric risk to the upside at current levels, the main risks to our thesis are the emergence of competitors to key drugs (e.g., Dupixent) and/or setbacks in later-stage key pipeline drugs (e.g., amcenestrant, tolebrutinib). With business development/M&A being a key driver of pipeline reinvigoration the risk of misjudgement in capital deployment is real. However, new management are also acutely aware of past mistakes (e.g., Bioverativ) and we therefore view the risk of future poor decisions to be fundamentally lower. Recent progress in the business has ended years of broker downgrades. Broker forecasts are now inflecting upwards and we expect that to continue.

Consensus estimates (FactSet) show major pharmaceutical peers collectively trade at ~16.2x PE on a 12mth forward basis. We estimate that Sanofi’s current 25% PE discount to peers will narrow towards a ~10% discount, resulting in a target 14.6x PE multiple. Applying our 2022 EPS estimate of at least €7.60 per share to this target multiple suggests fair value to be ~€119 per share or ~35% upside to current levels. We see multiple avenues for upside to both our earnings forecasts and the PE multiple.

Sanofi will need to continue delivering on operating execution and pipeline, where on both fronts current trends are encouraging. Capital management initiatives provide further upside to our case, particularly in the event the Consumer Healthcare business as flagged is sold and if M&A accelerates delivering a more material pipeline contribution to the near-to-medium term earnings outlook.

Subscribe to receive the latest news and insights from the Antipodes team