Artificial intelligence (AI) stocks surged in 2023 on the back of forecasts that AI is set to transform the way we operate in both business and society. Some of these stocks have reached valuations that leave investors with little room for error in terms of setbacks such as revenue disappointments. However, we believe the chipmaker TSMC still offers good value and has robust growth prospects given its pivotal role in the AI revolution.

AI was one of the key investment themes of 2023, and many AI-linked stocks soared in value over the course of the year. That reflects optimism over the way AI could transform businesses and economies and hence the potential revenue and earnings growth for stocks that are critical to AI’s development.

The long-term outlook for AI is exciting, but the risk is 2023 included an element of one-time or pull forward investment, and there are many companies that are priced for this to continue at a sustainable run rate. These companies will be vulnerable to a de-rating if demand fails to meet the market’s expectations. However, TSMC is an AI beneficiary that can thrive over the long-term but remains available at an attractive valuation. TSMC’s share price performance has lagged many other AI beneficiaries, and it is currently priced at a record discount to the wider semiconductor sector. Its shares are currently priced at 15x forward earnings (December 2024 earnings), a substantial discount to some of the more popular AI beneficiaries. In Antipodes parlance TSMC’s valuation offers investors a Margin of Safety, while many others are priced with little – or no – room for error.

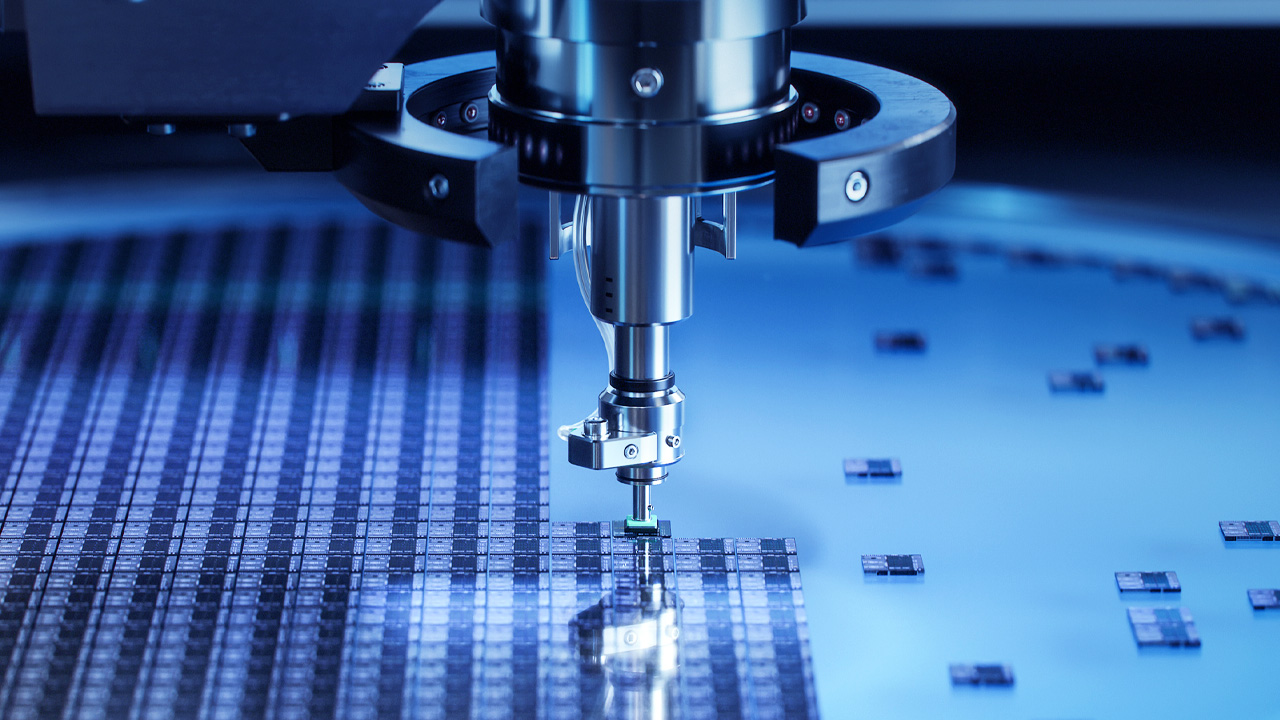

The Taiwanese chipmaker is a key enabler of AI. It is the largest chipmaker in the world, manufacturing leading-edge chips for the likes of Apple, Nvidia, and Qualcomm, and other semiconductor companies globally. The AI semiconductor market is expected to be worth around US$119.4 billion by 2027, accounting for nearly a fifth of the total global semiconductor market, according to Statista.1

The chips required for generative AI workloads and applications come out of TSMC’s fabs – the manufacturing plants where raw silicon wafers are turned into integrated circuits. Around four in five businesses will use generative AI by 2026, according to a forecast by the US research company Gartner, up from less than 5% in 2023.2

TSMC has invested heavily in developing the technology and the productive capacity to drive the AI revolution. This includes increasing capacity in Taiwan, but also building fabrication facilities in the US and Japan at a time when key customers are looking for incremental capacity outside of Taiwan. TSMC is now in a position to harvest the benefits of those investments in terms of growth and profitability. That would mirror its success in exploiting the explosion in demand for smartphones that took place from 2010 onwards.

TSMC is battling two other companies, Intel of the US and Samsung of South Korea, to develop the next generation of the world’s most advanced chips, but today TSMC still has a near monopoly at the leading edge. That reflects TSMC’s technological lead over its rivals in this area of the market and its ability to produce the most advanced chips at volume. Hence its critical position in the AI supply chain.

Recent results suggest TSMC is already seeing the benefits of rising demand for AI-related chips. In January 2024, the company reported that fourth-quarter revenue beat estimates of a decline, with demand from AI helping offset sluggish smartphone and laptop chip sales.3

Furthermore, TSMC expects demand for smartphones and personal computers to pick up in 2024 after a long downturn, providing a further boost to earnings.

An improvement in the phone and PC market, combined with growth in demand for AI chips, could make 2024 a strong year for TSMC and lay the foundations for robust growth going well beyond this year.

1 https://asia.nikkei.com/Business/Tech/Semiconductors/Global-chip-demand-to-rise-by-2nd-quarter-of-2024-experts-say.

2 https://asia.nikkei.com/Business/Tech/Semiconductors/Global-chip-demand-to-rise-by-2nd-quarter-of-2024-experts-say.

3 https://www.reuters.com/technology/tsmcs-december-sales-down-84-yy-2024-01-10/

Subscribe to receive the latest news and insights from Antipodes

IMPORTANT INFORMATION:

All content in respect of the Antipodes Global Shares (Quoted Managed Fund) (ARSN 625 560 269), the Antipodes Global Fund – Long (ARSN 118 075 764), the Antipodes Global Fund (ARSN 087 719 515), and the Antipodes Emerging Markets (Managed Fund) (ARSN 096 451 393) is issued by Pinnacle Fund Services Limited ABN 29 082 494 371 AFSL 238 371 (“PFSL”) as responsible entity of the Funds and is prepared by Antipodes Partners Limited (ABN 29 602 042 035) (AFSL 481580) (“Antipodes”) as the investment manager of the Trust. PFSL is not licensed to provide financial product advice.

The information provided is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Funds, you should consider the current Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Funds and the Fund’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au, and assess whether the Fund is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser. The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the relevant Fund are available via below links. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Links to Product Disclosure Statement: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

Links to Target Market Determination: IOF0045AU, WHT0057AU, IOF0203AU, WHT3997AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

Neither PFSL nor Antipodes guarantees repayment of capital or any particular rate of return from the Funds. Neither PFSL nor Antipodes gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this content. All opinions and estimates included in this website constitute judgments of Antipodes as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.