Tencent is a digital empire that is embedded in the everyday life of the Chinese consumer. The core social messaging app WeChat has been leveraged to offer users media/entertainment content, eCommerce, payment and financial services solutions to name a few.

Tencent has also invested in a range of technology companies and in the gaming and cloud verticals to broaden its offerings. The company has built a valuable asset based on unrivalled user engagement and exposure to large addressable markets.

Irrational extrapolation

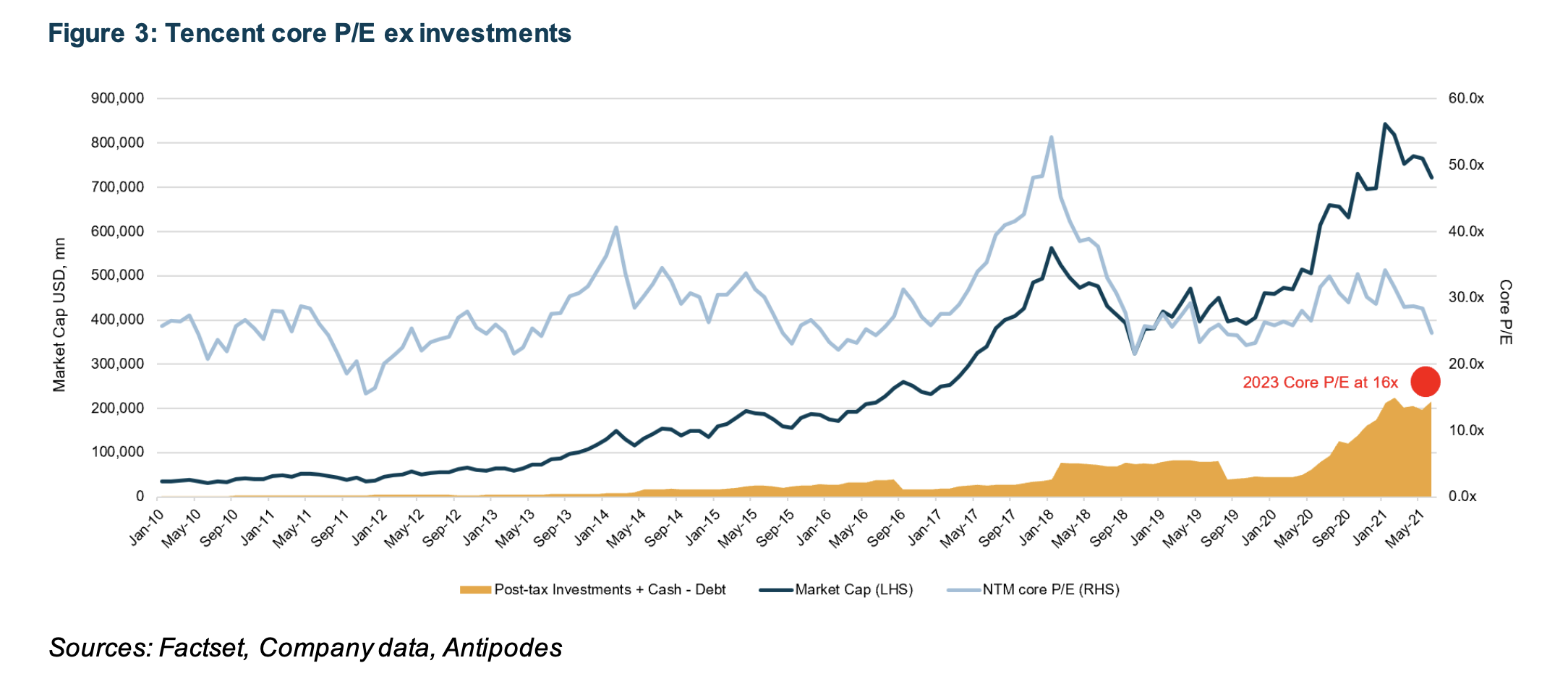

Tencent has undergone a significant valuation de-rate since the beginning of the year amid weakening Chinese economic data, from buoyant levels, and increased regulatory scrutiny and uncertainty across the Chinese internet sector.

The same types of stocks in the US are trading at close to all-time share price highs, although in both cases the stocks have de-rated relative to very strong earnings growth. In addressing these concerns, our base case remains that changes in regulation are designed to prevent anticompetitive behaviour, particularly in the e-commerce space, rather than stifle the growth of internet businesses more generally.

In this context, Tencent’s core advertising asset, WeChat, is less likely to be directly impacted by regulation than e-commerce peers such as Alibaba. Further, online gaming, which represents roughly 40% of group revenue, went through a rigorous regulatory process three years ago so Tencent has experience in navigating these issues. More importantly, competition is increasing across both ecommerce and online advertising in China as new customer channels are emerging (such as community group buying) and with the evolution of new social platforms (Douyin/ TikTok and Kuaishou).

In the most part these platforms are not direct competitors to Tencent’s business. However, as the platform with the highest time spent, Tencent is competing for eyeballs and ad spend against these fastgrowing apps. Although such interlopers may fragment the opportunity for Tencent, their impact is insignificant compared to the material growth in digital ad spend and the extent to which Tencent is currently under-monetised.

Tencent is also ramping up investment in three key areas: development of long production games, short form video and enterprise software.

While the market may penalise the stock due to some uncertainty regarding the shorter-term payoff from these investments, these initiatives will strengthen Tencent’s position in key verticals, build barriers to entry against smaller players, and drive growth and market share over the long-term.

Business resilience/Multiple ways of winning

Competitive dynamics & product cycle Tencent has built a formidable lock on the Chinese consumer as it has developed online solutions for the most necessary daily utility-like activities.

The core WeChat platform has morphed from its origins of a simple messaging platform. Consumers now use the app for media & entertainment content (games, news, video, music), official accounts (similar to Twitter), eCommerce mini-programs (branded shopfronts) and financial services (payments and wealth management) to name a few.

The strength of this platform is evidenced via its 1.2b Monthly Active Users (MAUs) on the core WeChat app, of which 82% will engage with the app on any given day for an average 84 minutes (and this excludes separately linked apps such as Tencent music). This provides Tencent with valuable user data and creates a direct portal to the consumer – ultimately it enables Tencent to provide a superior return on investment for advertisers.

The company is currently not monetising its powerful position to its full potential, with just a 12% share of the Chinese digital ad market.

Some new initiatives in videos, WeChat Moments (similar to Facebook newsfeed) and monetisation of the WeChat mini program GMV are all potential ad revenue sources, not all of which are in our base case, that could materially fast-track the opportunity.

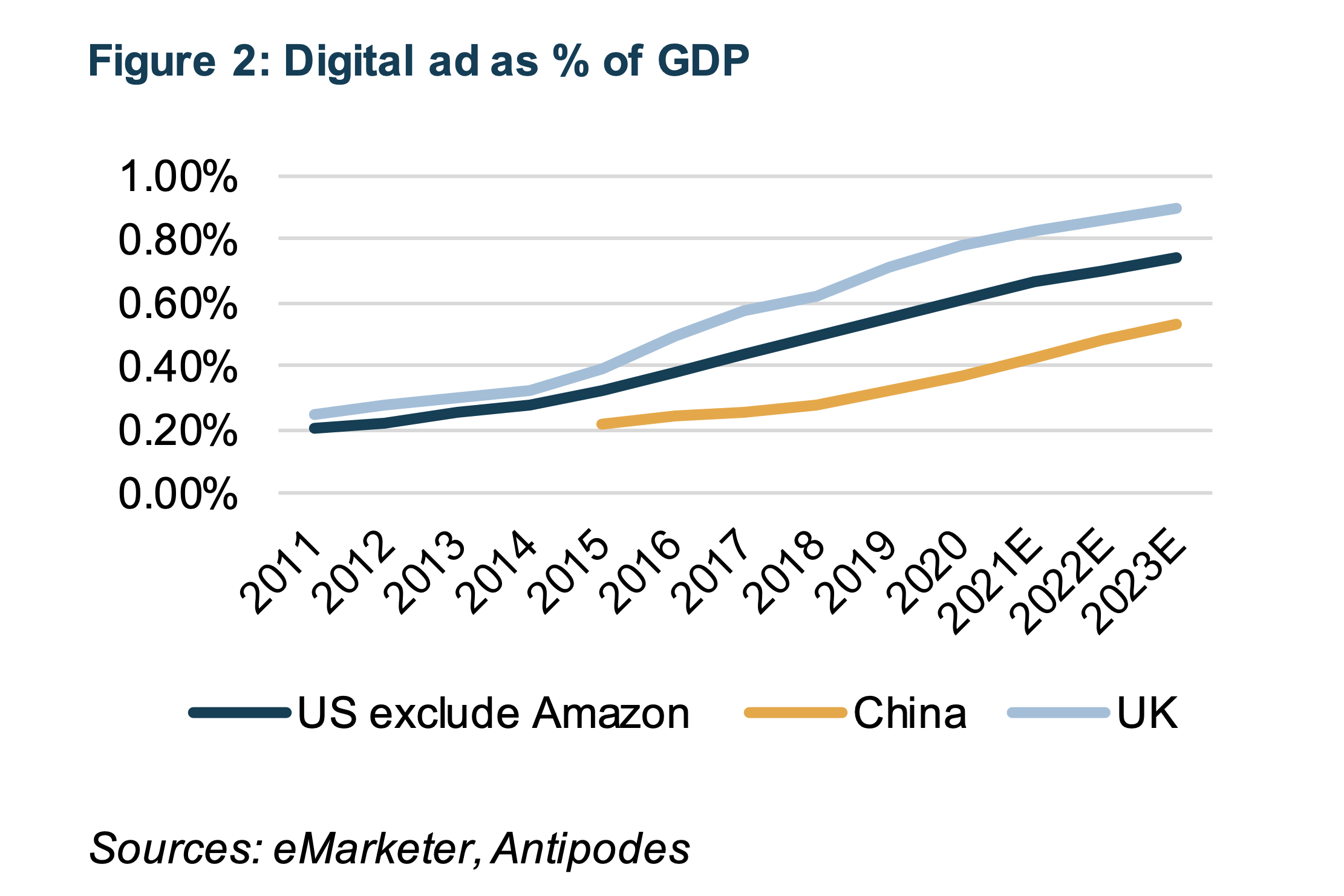

The penetration of digital advertising in China is still low relative to developed markets. Beyond a moderate and consistent share gain there is material upside in digital ad growth in China, which currently equals just 0.4% of GDP compared to the US at 0.6%. Given the rapid technological adoption seen in China as the country develops there is no reason why digital penetration will not reach similar levels to that seen in developed markets.

Tencent has leveraged its platform into fintech services which provides another avenue for monetisation. It is the leading offline payment tool and is catching up in online payments through its mini-program GMV (up 100% in 2020).

The company is a powerful third-party distribution partner for financial product issuers across wealth and insurance products and in credit lending where Tencent only refers business to its 30% owned WeBank to avoid the ire of the regulator.

Gaming is an adjacent vertical that Tencent dominates, with its 60% market share in China. The company has strong publishing and distribution capabilities as well as a library of established titles that make it difficult for a competitor to catch up outside of one-off hits.

Again, engagement with the consumer is high as the time spent per daily user on key titles is 100-140 minutes.

There is also an attractive global opportunity given its strong content JVs and world class internal game development; the global gaming market is four times larger than China’s at $160b.

Finally, Tencent’s Cloud business (number two in China) has potential for meaningful growth over the medium term. Cloud adoption is still in its early stages in China outside of the internet verticals. We expect this to ramp up with the development of PaaS (Platform as a Service) and SaaS (Software as a Service) products providing value added services to customers and a higher margin business for Tencent.

This business differs from the consumer focused core, but is synergistic given the great deal of content and data that is managed and as Tencent continues to work with investee companies.

Regulatory

China is in the process of implementing new regulations in three key areas: to restrain monopolies, govern fintech firms and protect data privacy and security. The Cybersecurity Law (enacted in 2017), Antitrust Guidelines for the Platform Economy Industry which became effective in February 2021, the Data Security Law (already released and comes into effect in September), and the Personal Information Protection Law, which just underwent its second draft and is expected by end of 2021, are all the result of this effort.

Alibaba,with the surprise cancelation of the Alipay IPO, and as the recipient of the largest fines,would seem to have been the major target of new regulations. Details of this greater regulatory scrutiny and investment implications include:

- Antitrust Guidelines for the Platform Economy target the dominance and potential anti-competitive behaviour of the major e-commerce platforms. The new regulations make it illegal for the platform companies to restrict suppliers to exclusive deals, use technology such as algorithms or data/traffic throttling to behave in an anticompetitive fashion and price/offer discriminate between consumers.

- As a result of new fintech regulations, Alipay, et al, is now required to hold a higher level of regulatory capital against any loan originations.

- A focus on domicile of listing,especially for companies that are considered to hold large and sensitive datasets – witness the recent “punishment” of ride-hailing app Didi for listing in the US. The variable interest entity (VIE) structure is used by Chinese technology platforms to access foreign investors and avoid running afoul of Chinese ownership laws AND at the same time often maintain voting control in a similar manner that the large US founder-led platforms such as Facebook and Alphabet have done via super voting class shares. Chinese authorities have announced that they plan to review and amend special provisions concerning the listing and capital raising activities of Chinese limited stock companies outside of mainland China, with VIE structured companies potentially requiring approval from onshore regulators before listing offshore. The motivation for this would appear to be two-fold: Chinese capital market reform and control. China ultimately wants its leading companies to be accessible to Chinese domestic investors by encouraging a move in the primary listing to either Hong Kong, accessible to the mainland via the stock-connect program, or the mainland. This would seem sensible and positive at most levels and has been happening for some time, initially in response to US legislative threats, with three of our current holdings (JD.com. Trip.com and Yum China) having listed in Hong Kong in the last 12 months. The global strategies do not have exposure to Chinese ADR’s that do not also have a Hong Kong listing.

In Tencent’s favour, via its mini-programs which facilitate the operation of independent store fronts, it is enabling greater ecommerce competition and in that regard the company appears better positioned to weather greater scrutiny.

Further, the company has incubated and co-invested in many start-ups across different verticals, providing access to the platform and technologies with the objective of improving consumer experience and to benefit from co-investment.

Finally, gaming and fintech have come under regulatory scrutiny in the past and the company has navigated these challenges and made appropriate changes to its business to remain compliant. Uncertainty is not good for short-term sentiment and it will take time for this to dissipate.

However, when we stress test each of our holdings they are all in good shape to manage the regulatory risk. Our experience with Facebook shows that heightened regulatory concerns, all else equal, allow incumbent companies to build even higher barriers to entry and hence can prove to be buying opportunities.

Management and Financial Management has a clear vision of maximising long-term outcomes as larger addressable market opportunities are identified,as well as striking a balance between monetising these efforts while ensuring a positive user experience and navigating the regulatory environment.

Ultimately this will likely hold monetisation below levels seen at counterparts in the developed world (as is the case across the broader China internet space). However, this model will position Tencent’s platform to become utility-like with an exposure to the fast-growing Chinese middle income and premium consumer which should translate to a 15%+ p.a. structural growth opportunity in the long-term.

Style and Macro

Tencent offers cheap exposure to the quality and growth factors, though at times China macro will weigh on these defensive characteristics.

Valuation

The internet sector globally is one of the few sectors where valuation dispersion is low as most stocks have re-rated to high multiples versus history.

The exceptions tend to be some of the larger capitalisation stocks such as Facebook and Tencent which not only trade cheaply relative to their historical multiples but also relative to the broader sector.

Tencent’s core business is priced at 16x 2023 earnings with additional value coming from its other digital investments with attractive long-term opportunities (currently valued at $250b or 37% of market capitalisation). This is in line with the world average multiple despite Tencent growing earnings at around 20-25% p.a, that is a much higher rate than the average company.

This also represents a material discount relative to the company’s five-year average valuation premium of 100%. On this basis we see material upside.

Margin of error

The key risk to our case is that Bytedance, which has been taking time share from Tencent since 2018 (it has over 1bn MAU and 600mn DAU now), could continue to pressure user time spent on Tencent properties.

Further, regulatory headwinds in the education sector could impede advertising growth in this vertical and the launch of Digital Currency/Electronic Payments (DCEP) limits upside in offline consumption take rate.

Cloud services are also still in nascent stage where there is a lot of supply but demand is yet to catch up.

So while there is high confidence that the payoff from investment in this area will be significant, it may take longer than expected.

Finally, regulatory risks are rising across mega-cap tech and Tencent may face regulatorimposed penalties that are larger than expected. Developments in the competitive environment and regulatory landscape need to be closely monitored, however the above risk factors are accounted for in our thesis by taking a cautious view of monetisation in our base case.

Subscribe to receive the latest news and insights from the Antipodes team